If you are wondering whether it is time to worry about streamlining your corporate performance function, an article and survey in CFO magazine lays out a clear case for it. [1]

A CFO who can accurately report on the financial position of his or her organization with great detail and insight - and on a timely basis - is empowered both immediately and in the future. For today, that accurate financial snapshot clarifies competitive positioning; for tomorrow, it enables planning that is actionable, constant, and fluid.

For most CFOs, unfortunately, assembling a financial snapshot that contains "great detail and insight" can be a slog. They don't have the technology or processes to paint an accurate portrait of the business or, if they do, they can't generate it quickly enough for it to be of great use. What is needed at these companies? Nothing less than a transformation of the way finance handles and uses the data the organization generates.

It all comes down to results

Ultimately, for any business, it all comes down to results. And results can only come from strategy, decisions and flawless execution.

"Execution requires a comprehensive understanding of a business, its people, and its environment," says Ram Charan in Execution: The Discipline of Getting Things Done. "Organizations don't execute unless the right people, individually and collectively, focus on the right details at the right time."

Getting people to focus on the right details is the job of your performance management system. Your finance function lies at the heart of corporate performance reporting; so much so that in many small and midsize firms they are sees as one and the same thing because the same people do work on both.

Whether highly sophisticated or utterly simple, your corporate performance management (CPM) system plays a critical role in highlighting issues begging your attention. But change can come only if you-as a leader at any level, as CEO or unit manager-pay attention to the business, your people and the environment and are determined to take action on what you see. Change can only occur if your business approaches CPM as a forward-looking process, rather than a backward-looking one.

Data drives focus and decision making

Whether it is big data analytics at large firms, corporate performance management reports at mid-sized firms or monthly or simple weekly performance reports at small businesses, it all matters. Your data determines the value of your strategic insights. These insights, in turn, determine the quality of your decisions and business results.

Data tells stories, offer valuable insights, prompts action

Your insights become all the more valuable when you can get at the whys and whats and hows of the variances and patterns reflected in your data. Percentages and variances don't mean a thing if you fail to understand what lies behind them both operationally and strategically.

Also, nothing matters an iota if you do not use these insights you gain to take useful and decisive action.

Action orientation should be a guiding mantra for leaders at all levels within your business. Whether that is improving your supply chain efficiency, or segmenting your market with more precision or exploring potential new products and market segments or merely trying to get managers and leaders to take on more responsibility, the more precise your insights, the better your decisions will be.

And the better informed you are, both qualitatively and quantitatively, the better outcomes you can expect when your decisions are executed.

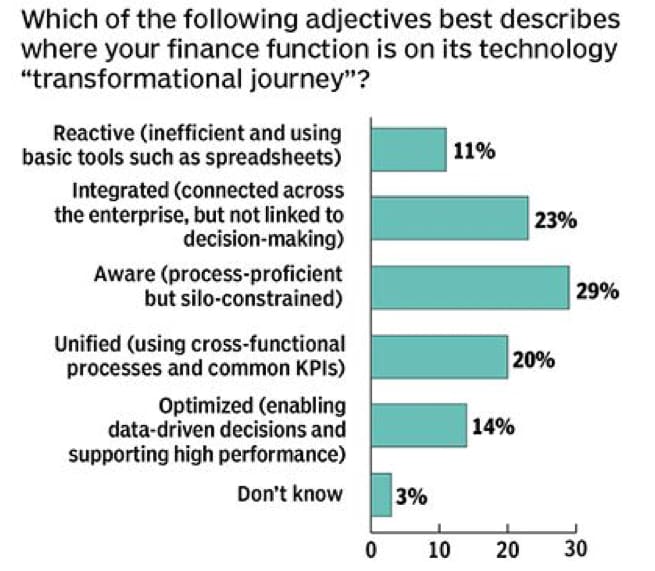

No one understands the value of data more than your Chief Financial Officer (CFO) and finance professionals who support your decision making on an ongoing basis. What CFOs think about the status quo on technology supporting the finance function and how they view the future is clear from the survey results noted in the CFO article we referred to above.

Source: CFO Magazine

Note how nearly two thirds (63%) of company CFOs and finance professional report their firms are way behind on their technology transformational journey. One in ten companies (11%) have limited access to technology and are using basic tools such as spreadsheets.

Nearly one in four (23%) report some level of technology integration across enterprise, but yet, are not linked to decision support systems. Nearly a third (29%) report to being process-proficient but silo constrained.

Just one fifth of companies say the technology transformation in their firms are unified, with cross functional processes and common Key Performance Indicators (KPIs).

A mere handful of finance professional report that their companies are optimized in terms of technology transformation in the finance function (and decision support systems) which support and enable data-driven decision making and high performance levels.

Over all, just a third of the companies, according to their CFOs and finance professionals can be categorized under the "aware" and "unified" in terms of technology transformation of the finance and decision support.

It is also clear from the survey results that this sad state of affairs is not due to lack of awareness, enthusiasm or interest on the part of finance executives themselves. Then the ball is directly in the court of the CEO and the Board of Directors.

Spend more time on quality of insights

You employ people with expertise to give you insights from interpreting data. But if they are overwhelmed by the report generation process, they lack the time necessary to provide quality insights. Although the focus should be on generating insights, in most companies, people spend most of their time juggling with data from different systems; copying and pasting from one worksheet to another; importing and exporting; merely generating reports.

For them to focus on what matters - identify forming trends, why things are the way they are and how they impact your business and to suggest ways to change things - they need more time. That can only come from a leadership team that appreciates the critical role of quality of insights in business success.

A CPM system that empowers

A performance driven culture makes it clear that data analysis and interpretation, as opposed to mere report generation, is critical to business success. If your people don't know this, the blame may not entirely be theirs. In many companies, especially small and mid-sized companies, the leaders expect nothing more than report generation. It is not that they don't want the interpretation, but that it many never have occurred to them to have someone actually get into the thick of things and see why things are the way they are.

Secondly, your CPM system must empower those using its reports and features. There are smart and efficient ways of getting those insights and there are stupid and inefficient ways. Ask any management accountant, data analyst or finance executive and they'd tell you horror stories that would make you go home and tell your kids never to go into finance; never to become an accountant.

But corporate performance management does not really have to be this way.

The more you empower the decision makers at all levels, the better your company will perform. This is true whether your 'top management' comprises just the CEO, a Board of Management or a team of C-suite executives. All decision makers and all companies can benefit from such a process.

How can you empower decision makers?

You do this with corporate performance management processes that empower report generators as well as end users up and down the organization.

We have seen companies where the accountants churn out fat reports for the weekly management meetings and managers from each division being called upon the mat to explain variances. Sometimes these managers have not even seen the reports and the variances they are supposed to explain.

This is not how things should be.

Wouldn't it be far better for manager to be able to see and understand variances - whether one off, or persistent - with their teams and figure out what the issues are and what led to those variances? Perhaps they can call on additional CPM reports that help them dig into what the causes may be.

And wouldn't it be great if those same people and their team leaders and managers had real time access to their own performance so that they can troubleshoot variances as they occur, without waiting for period end reports?

People closer to the trenches know the lie of the land than those in the C-suite. Those in top management positions see the bird's eye view. Effective strategic decisions come from the careful and skillful merging of top down and bottom up insights.

Wouldn't it be better for the top management to be presented with an issues report, together with ideas and suggestions from the leaders closest to the front line on how best things should be addressed? Putting in place such a process would not just empower users in the middle; it would also ensure that 'upward' movement of qualitative information leads to better decision making at the top.

Conquer data gathering and the reporting frontier

Data gathering, analysis and presentation can easily be the final frontier in which companies can find immense time savings and productivity. All the other processes have already been streamlined in many firms.

The need for data analysis and decision reporting in a company almost always evolves in an ad hoc manner. This is very common in all but the largest firms. Unlike the operational systems which receive the scrutiny of both internal and external auditors, no one really looks at a decision support systems with the view to rationalize them. They evolve ad hoc, in accordance with company growth; reflecting needs of new CEOs and decision makers; and according to whims of financial professionals who came before. As a result, in most firms there is much scope for improving and streamlining management reporting systems.

This is true for most Australian and overseas firms we have worked with.

You would imagine isolated islands of information, data fiefdoms and issues of report generation belong in history books. You would like to believe that, in this 21st century of mobile apps, integrated cloud solutions and the Internet of Things, that people waste no time generating reports. You would imagine reports are generated automatically at the press of a few buttons. You would imagine many systems are integrated making them efficient and productive.

But you would be wrong.

In many companies, people still spend much of their time entering and reentering data for report generation. If you look closely at your management and decision focused reporting, you'd find many repetitions, obsolete and stupid processes that make little sense. It is amazing, but true.

The good news is that you no longer have to put up with it.

Automate the critical processes; eliminate the stupid

One key method of empowering data analysis is by automating critical processes and by eliminating the stupid processes that eat up time without adding any value.

Both free up your bright analytical minds to focus on finding the stories behind the data, developing trends and unusual variances. They will have time to work with respective operational teams to understand issues and come up with practical, workable solutions. Overall, your business becomes more adept at highlighting strategic insights and leveraging them towards decision making.

Here's how to go about finding and eliminating the stupid processes while getting better value from your internal reporting and decision support systems.

1. Make a list of all the reports you generate for performance management.

Here are some questions you need to answer about each report:

- Who generates it?

- What information is included?

- How often are these reports needed and why?

- Who wants them and what do they use them for?

- Are all bits of information included in each report used by the end users? Or only some of it? Why and why not?

2. If you are really data driven, try to estimate how long it takes for each report to be created.

You will easily find that a lot of that time can be saved if you have a way of integrating data from different systems and processes which are not integrated.

3. List all the sources and inputs used for generating the different reports.

The more integrated your company systems are, the fewer resource inputs you will have.

But if your company is still rife with silos and islands of information gathered and used in isolation, the more input sources you will have. The more there are, the bigger the waste of time you will encounter when preparing performance management reports.

You will find many stupid processes to eliminate and many was to streamline processes as a result of this analysis.

4. How many people are involved in preparing reports for performance management in your business?

That generally depends on the size of your company, nature of your operations, the geographical spread of your operations, sales volumes, product or service range and the size of your finance and IT functions.

If there is more than one person involved in generating these reports, it makes sense to talk to each individual. Would you be surprised to find the same data being imported, exported, copied and pasted and manipulated multiple times; sometimes by the same person, and sometimes by different people?

There is likely to be a whole lot of duplication of effort at various levels and stages. These are also stupid processes that can be eliminated, if you can find a way to achieve the same goals but without duplication.

5. Look into how many reports require manual data entry, merging and manipulation.

That is, are there repetitions of data entry besides the first time data is entered into any system within the firm? Remember, each time someone re-enter data, manually, more and more errors have a chance of creeping in.

Find out what controls are there to ensure integrity of data entered. Review the imports and exports. Ask how often it happens.

6. Discover the common factors. Seek ways to streamline and automate your processes.

- How can you eliminate unnecessary and duplicative efforts?

- What processes need to be automated?

At the end of this exercise, you would have a clear map of your corporate performance management needs, as they currently exist, and what processes are critical to meet those needs.

What you do not need

As noted before, the solution to your problems in corporate performance management isn't getting yet another fancy dashboard or a flashier Business Intelligence tool.

What you need in a good CPM system

- You need a solution that helps you streamline the way your business performance data becomes business intelligence capable of providing you critical insights on your operations and business strategy.

- You need a way to automate your streamlined data and reporting needs. That is, a tool that is flexible, reliable and user friendly.

- Beyond that, you need a tool that can close the performance management loop by prompting you and your team into action, and that allows you to monitor the success of your execution.

Your job is finding such a tool. We are positive that we can help.

The MODLR Team

[1] Chris Schmidt, The Road to Finance Transformation, CFO, August 1, 2017. Accessed online on 15 September 2017 at http://ww2.cfo.com/technology/2017/08/road-finance-transformation/