3-way Forecasting Guide Contents

- What is a 3-way forecast?

- Why are 3-way forecasts an integral part of forward planning?

- How to prepare a 3-Way forecast

- Leverage features of MODLR for 3-way forecast success

- Schedule a demo of MODLR's 3-way forecasting solution

What is a 3-way forecast?

The key financial statements of a business—the cash flow statement, profit and loss statement and the balance sheet—are essentially documents that look backwards. They offer hindsight to what happened in a business during a given period and how things stood at the end of that period. All forecasting, including 3-way forecasting, in contrast, compels you to look forward.

Increasingly more and more businesses and their banks want to know how their strategic and operational plans would affect future cash flows, profit and loss situations and their asset and liability positions. Three-way forecasting enables you to do exactly that by integrating future cash flows, profit and loss results and balance sheets into one single document, model or spreadsheet.

New and existing businesses seeking bank loans will be asked to provide a 3-way forecast for their business or project as part of a loan application. Integrating all financial statements together into a single 3-way forecast makes your business planning process so much easier. And banks would appreciate the end result when evaluating a bank loan for your business.

Why do you need to create a 3-way forecast?

There are many advantages to making a 3-way forecast for your business. They help us understand key business drivers and dynamics. They are useful for evaluating the impact of strategic business decisions. For the same reasons, lenders and investors may ask for a 3-way forecast to get better insights when evaluating lending and investment decisions.

3-way forecasting forces us to identify key business drivers

Just as you make assumptions when drawing up any kind of business projections, 3-way forecasts also require you to understand and consider what key business drivers impact your business and how. Thinking in this way makes it easier to understand the business dynamics of how different factors interact. They can tell us how different decisions create an impact across your business over time. Better insights must naturally lead to better decision-making.

3-way forecasts help reduce uncertainty

All business decisions are made with a certain level of uncertainty. However, all business projections including 3-way forecasts help manage that uncertainty by shedding light on potential future outcomes. They offer an infinitely better option than merely waiting to see the final outcomes in the rearview mirror. Running 3-way business forecasts can help you take proactive measures to issues and trends that can have a direct impact on your business results and operations.

3-way forecasts lead to more robust business plans

Think of a 3-way forecast as a virtual dry run of your business decisions. You can see how exactly your decisions would affect your business. Three-way forecasts demonstrate how business decisions can impact your financial results, the balance sheet and the cash flows of your business over time. Having such insights helps you make your business plans more robust. Rather than making plans, implementing them and seeing their impact, 3-way forecasts help you get a peek at how things would likely turn out and enable you to make necessary changes to arrive at better outcomes.

Help understand the impacts of strategic and long term decisions

Three-way forecasts reflect the impacts of your strategic business decisions and investment projects. You can know how each potential decision can impact your financial results, your balance sheet and your cash flows going forward. This is immensely helpful for evaluating the pros and cons of different business and investment decisions.

Lenders and investors use 3-way forecasts to get better insights into your business operations and expansion projects

The biggest benefit of 3-way forecasting, quite often ignored, is that the mere process of making the forecast—or any type of business plan or projection for that matter—enhances the understanding of business dynamics and the key business drivers that impact a business. This is immensely useful when making future plans for any business, big and small. And lenders and investors count on 3-way forecasting to provide these insights. That is why quite a lot of lenders and investors these days ask for 3-way forecasts from borrowers and investors.

What time period should your 3-way forecast cover?

The time period your 3-way forecast should cover depends on the circumstances. For most businesses, it is sufficient to make 3-way forecasts that cover one year. If you or your lender is looking at strategic and long term plans, you may want to do a 3-way forecast that spans the planning period, which could be anything from a few months to one year, or even up to five years and longer.

Running a 3-way forecast once is not the end of the road. As your business evolves and plans are implemented, you need to repeat this exercise going forward so that you can get an idea of how your business results, cash flows and asset and liability positions are affected.

How often should you run a 3-way forecast for your business?

3-way forecasts for operational purposes.

You may want to do a 3-way forecast monthly, quarterly or annually for your regular business planning and operations.

3-way forecasting for strategic planning and investment projects

If you are considering longer time horizons, for strategic planning and investment projects, for example, you may want to perform 3-way forecasts on an ongoing basis, each year and continue to do so in order to see how varying business dynamics affect the way your business performs. The factors that may impact your business on their own and collectively include market interest rates, foreign exchange rates, inflation and business growth. Depending on the industry and business sector, and the time frame of the forecast, other factors may need to be considered. These may include wage growth, consumer preferences, spending patterns, demographics and technology adoption.

3-way forecasts for lenders and investors

For the purpose of funding new projects or large scale capital injections, your bankers and other lenders and investors may ask for long term 3-way forecasts. These forecasts can range anywhere from three to five years or even longer, depending on the project.

Why are 3-way forecasts an integral part of forward planning?

In the absence of a reliable crystal ball, businesses and bankers depend on forward planning and business projections. However, all these plans and projections are based on a set of assumptions about the business environment and business performance. If one or more of these assumptions change—and quite often they do—your projections lose their value as a basis for solid business decisions.

Also, it is impossible to calculate with certainty the impact of various factors that affect your business and your business environment. Consider the following questions, for example, that may arise in the normal course of business planning, investment or lending decisions:

- How will inflation rates change over our planning period?

- How would potential changes in foreign exchange rates impact the cost of imported manufacturing inputs or end products? How would that affect our trading operations?

- How does the impact of inflation or exchange rates or both impact our cost structures and as a result, our pricing?

- How would trends in local and regional economic growth or wage growth impact our local business operations?

- How would trends in global economic growth trends and other global factors impact our export volumes, foreign exchange rates and export revenues?

- How would increases or decreases in interest rates impact our investments or borrowings?

- How will changes in inflation, growth and interest rates impact our real estate operations and investments?

Just taking the example of the Russia-Ukraine war situation, you would see that it impacts global energy prices, global and local commodity prices, and transportation and power costs that are closely related to energy prices. Just this one war taking place far away can create so many negative impacts on global businesses.

Amidst the heightened business uncertainty, every entrepreneur, startup, business decision-maker, lender and investor must face and deal with the above and similar questions in order to run a sustainable business. The answers, or lack thereof, to such questions, can make or break our business expansions, sink new project funding and impact business growth and profitability. This is why 3-way forecasting should become an integral part of the business decision process.

"Running 3-way business forecasts can help you take proactive measures to issues and trends that have a direct impact on your business results and operations. That is why we say 3-way forecasts are an integral part of the business planning process".

How to prepare a 3-Way forecast

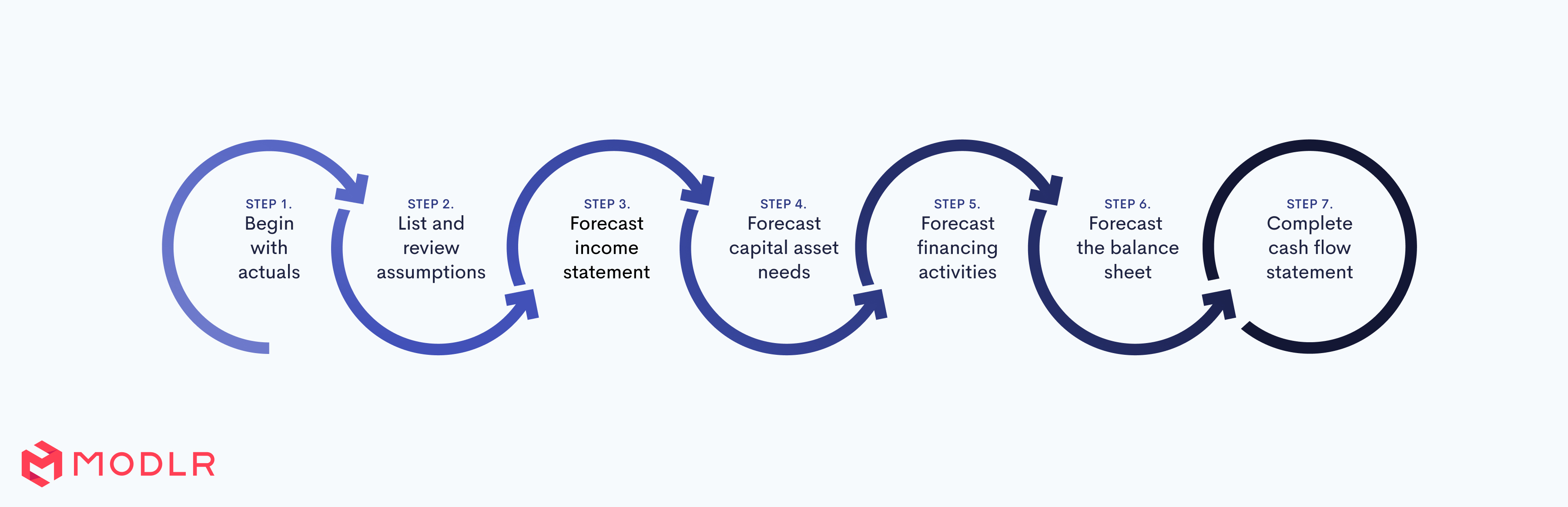

Making a 3-way forecast includes many steps outlined in the diagram below. Let us discuss each step of the process and how that combines into a complete 3-way forecast.

Step 1: Begin with actuals

Input historical financial information into a worksheet. For most businesses, this means using an Excel sheet or other accounting programme worksheet format. This is done by getting a trial balance from your enterprise resource planning (ERP) or accounting programme. You can also easily integrate MYOB, Xero, Quickbooks, Sage, Netsuite, SAP or another into this process.

Once this step is completed, you would also have ready templates and formats for all your projected financial statements together with relevant formulas to make the process easier.

Extracting historical data can be tedious and time-consuming. Recreating data formats, data entry or even copying and pasting data also carry the risk of human error. However, there are tools like MODLR that help you easily extract this data from all popular data sources by automating this process. We address this later in this article.

Step 2: Determine and review assumptions

Determining your assumptions is a critical early step in your 3-way forecasting process. Assumptions are fundamental factors that you take as given to make the forecasting process easier and simpler.

For example, you can make an assumption that the interest rate on a loan would remain at a given level during your planning period. But of course, this may change due to various global and local economic conditions. Therefore, in order to enhance the relative accuracy of your forecast, you need to make assumptions as close to ground realities as possible. Even then, that may not be sufficient. This is where creating different scenarios within a range of interest rate levels can help make 3-way forecasting more helpful and accurate.

A review of each assumption can also offer useful insight into exactly which forecasting methods may be most appropriate for you. When assumptions are clearly identified, it creates a common understanding among the forecasters and the business decision-makers about the goals and results of the forecasting process. Again having a tool like MODLR which supports a dynamic planning process can be infinitely helpful compared to juggling with Excel worksheets and different versions of the same document.

Four questions to ask about assumptions

It is useful to ask questions, such as these given below, when defining assumptions to be used in your forecast:

- What is the forecast time horizon? The forecast time horizon depends on why you are making the 3-way forecast. We discussed this above.

- What are the political and legal issues related to the forecast? Be aware of how economic policies and laws currently in effect or may come into force during the planning time horizon that can affect your forecasts. Changes in tax laws, industrial policy changes and concessions, business constraints, trade treaties and agreements can all impact the assumptions underlying your projections, making them inaccurate and therefore, useless.

- What assumptions are you making about the state of technology and technology adoption? This means the technologies that are used in your business and your business sector as well as in sectors that either feed into or are reliant on your business sector. We saw during the COVID-19 pandemic how some businesses, from the corner grocer, local restaurants and others, adapted to online and digital business. Some businesses fared well while others perished. So it pays to understand your assumptions about the use of technology by your business as well as by your key customers and suppliers. Keep an eye on how this may change and how those changes—say more customers placing online orders—can impact your projected results.

- How are our key customer groups and suppliers changing? The pandemic was a game-changer for many businesses, but the change was not merely about business models or technology. Individuals—your customers and employees—also changed their behaviours, lifestyles and purchase patterns. Many trends which we had assumed would eventually get here (so we have time to change) came overnight. Most things moved online. The gig economy saw a huge boost. Now, many people are reconsidering flexible, family-friendly gig work as a viable alternative to regular jobs with regular working hours. These changes in your consumers and employees and the way your competitors responded can also make a difference for you in the new normal. And the new normal calls for new assumptions.

Step 3: Forecast the income statement

The income statement, also referred to as the profit and loss (P&L) statement, records the sales revenues and expenses of a business. It is your P&L that tells you whether you are making profits or losses in your business and by how much. Typically P&L statements are prepared at the end of a period, which could be a month, quarter or a year.

P&L projections into the future help make your business plans more robust. When you want to evaluate a business plan, or how your operational and strategic plans are going to affect your business performance, you can make P&L projections for future periods.

Over the short term, your major revenue and expense or expenditure categories will likely remain the same. However, nothing is a given, as we saw during the pandemic. Many businesses whose online sales were insignificant saw regular, offline business dropping due to travel restrictions. There was a rise in online sales for those who were already online and from new operators. Those who were prepared, or were versatile and nimble-footed flourished while the less prepared businesses saw their customers move away. Sit-down restaurants had to move to take away or delivery operations. Grocery stores had to adopt a similar approach to survive. Service providers such as trainers, including personal trainers, adopted virtual training. Book stores and other retailers, many of whom were not into online ordering or delivery were compelled to do so. Some businesses had to entirely reinvent their business models in order to survive.

A lot of businesses saw their workplace costs go down significantly due to people working from home. Business processes moved online and went digital. There was less demand for paper copies. Travel and transport costs dropped. Meetings and conferences moved online and the costs of communication, networking, capital costs for information and communication technologies shot up. Labour cost structures, labour practices and people's working patterns also changed. Such changes have cost and revenue implications and therefore, can affect your assumptions and projections. Pandemic or not, it is worthwhile going through your revenue and expense categories to determine how the status quo may change due to some factor or another in your business environment.

Mergers and acquisitions, business consolidation, business closures by competitors, and changing business practices of key customer groups and key suppliers, all can impact your revenues and your balance sheet and cash flow position.

Step 4: Forecast capital asset needs

How will your capital assets change over the 3-way forecast time horizon? Will you need new capital equipment or need to expand business premises? Will your business model change during the forecast period and how will that impact your capital expenditures? Capita asset forecast must consider all these aspects.

Even if you do not foresee significant changes in capital investments, rising inflation, exchange rate movements, and disruptions of global supply chains may impact your business depending on the industry sector you are in. These all need to be factored into your capital asset forecasts.

Step 5: Forecast financing activities

Your regular working capital needs and any expansion projects need to be financed. To do so, you will need to forecast your financing needs together with relevant timeframes. Once you know, you can make plans to meet those needs.

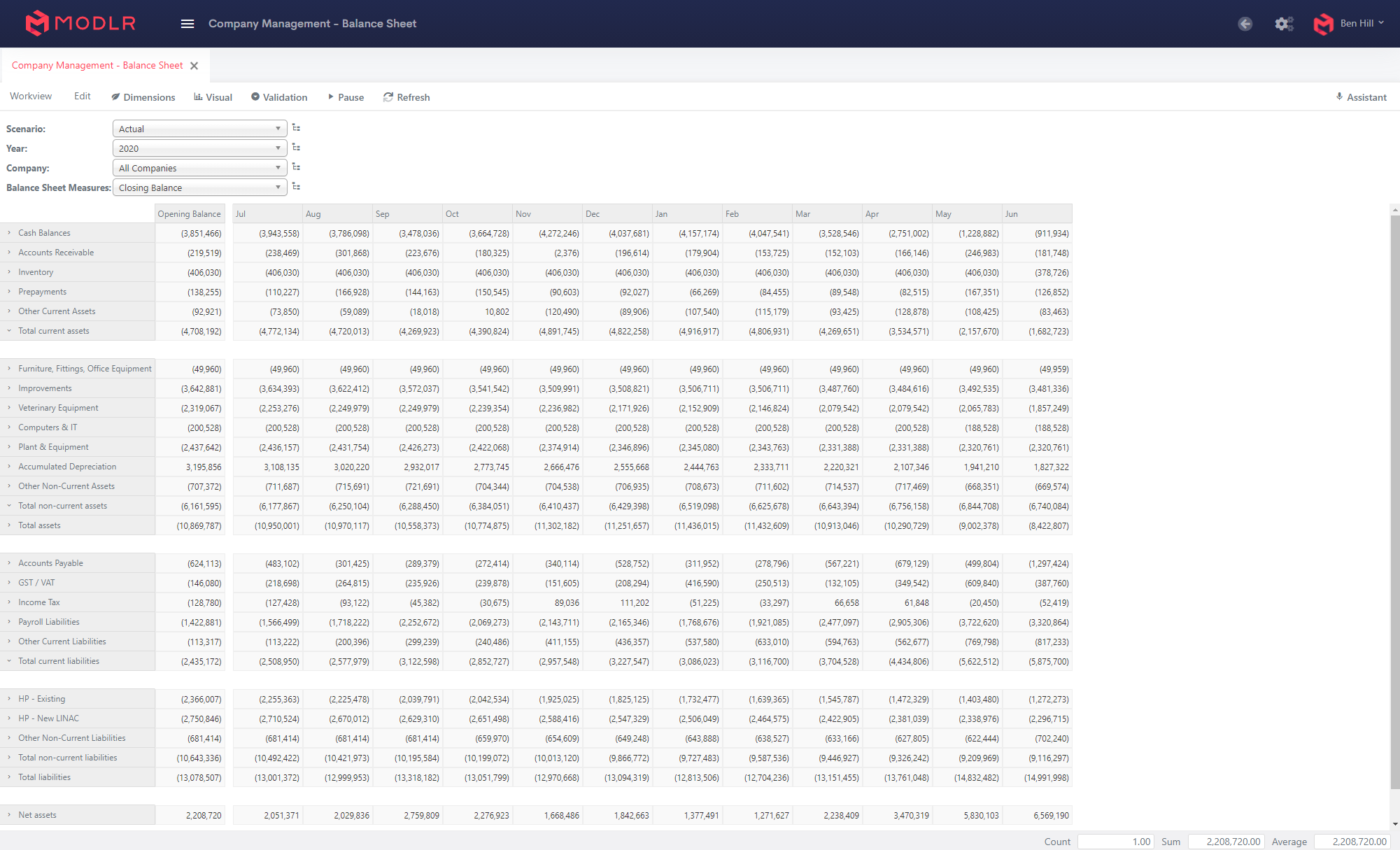

Step 6: Forecast the balance sheet

A balance sheet offers you a snapshot of your business at a given point in time and is a good tool to judge the financial health of your business. It shows what assets you own and what you owe (your liabilities) to others on a given date.

When you are making plans for your business, and create profit and loss projections for any future periods, you will also need to know how those financial decisions impact your balance sheet and how it would look at the end of that planning period. Projected balance sheets give you a snapshot of how your business assets and liabilities are likely to change as a result of those plans.

Changes in business models, revenue streams, expense category movements and new projects all impact your asset and liability positions and working capital requirements. These need to be carefully forecasted at the end of each planning period covered in your 3-way forecast.

Step 7: Complete the cash flow statement

A cash flow statement of a business, sometimes called a statement of cash flows, shows you how and where money is coming into the business and how and where it is going out of the business. Although it may look similar to a profit and loss statement at a glance, it is a different report. It only records cash inflows and cash outflows from your business; that is, of actual spendable money coming in and going out of the business. A whole lot more is involved in an income statement.

Review your forecast

Going through the above steps one time is not the end of your 3-way forecast. Once the first iteration is complete, it is necessary to review the 3-way forecast carefully to see whether the results are as you intended them to be, and are acceptable to you, your lenders and investors.

Often, you may find that your 3-way forecast does not meet your expectations in terms of results, cashflows or asset and liability positions. This is perfectly normal and to be expected. If your 3-way forecast is for investors or lenders, you can submit the document and rest easy. However, you may be asked to revise it.

The value of any forecast lies in whether and how you are using them to improve business decision-making. To keep your 3-way forecasts as accurate and as close to reality as possible, review the underlying assumptions on an ongoing basis. Ask yourself these questions during the periodic reviews:

- Does the forecast look realistic?

- What assumptions underlying the forecast need to be adjusted?

- What other key elements (besides the assumptions) need to be reset to make the forecast accurate.

The closer your scrutiny and more finetuned your assumptions are, the better the 3-way forecast will serve you in decision-making.

Consolidating the 3-Way forecast

Holding companies and business groups are required to consolidate their P&Ls, balance sheets and cash flow statements of their subsidiary and associate companies into a single set of financial statements, called consolidated financial statements. These are prepared according to an elaborate set of rules, taking the financial statements of all entities in a group. There are rules to prevent intercompany transactions from being double-counted and other potential distortions of business results.

As you can imagine, preparing consolidated accounts for a few companies can be a chore. But for groups with many subsidiaries and associate firms, this can be truly difficult and time-consuming, especially if they are prepared using MS Excel and other spreadsheet software. And then imagine the added complexity of consolidating the 3-way forecasts for all firms in a group, and doing this periodically on an ongoing basis. This is where automation comes in.

Automating the 3-way forecast

Software that enables automation of financial statement preparation can spare the time and effort of your accounting staff. MODLR, for example, has capabilities to integrate smoothly with various accounting and ERP packages to obtain data necessary to prepare period end and projected financial statements.

Where a group has several subsidiaries and associate companies and where businesses have geographically dispersed business units, MODLR enables easy integration of all those company budgets, financial statements and 3-way forecasts to be integrated on a single platform. You can also get the consolidation of 3-way forecasts done easily and smoothly, sparing your staff the laborious work involved if doing the same with regular spreadsheet software.

Reporting and the 3-way forecast

When you are preparing financial statements and the 3-way forecast for management accounting purposes, to support decision-making, you want to monitor how the performance of various functions, business units and divisions fare over time. You can do this by adding key performance indicators (KPIs) to your 3-way forecast.

If that sounds complicated, it is. But the insights you may gain from doing so make it worth the while. This is another instance in which automation helps. If you are using a versatile software like MODLR for forecasting, once you add your KPIs to the model, you may be able to call up periodic reports—daily, weekly, monthly, quarterly, annually or any relevant period—at the press of a few buttons on your dashboard.

Monitoring your 3-way forecast

3-way forecasts are complex since they cover three financial statements and extend over multiple timeframes. Monitoring and tracking significant variances and deciphering changes within a 3-way forecast over time is also complex.

Variance analysis is one tool that can be used in budgeting, forecasting and in management decision-making to narrow down areas we need to focus on. Yes, things can change. Most things will. Variance analysis simply helps you figure out which changes are significant.

For example, variance analyses can help you understand the following:

- What degree of impact does a new project have on your future profitability, revenues and cash flows compared to the past period, prior to that project?

- How much does a new quarter’s actuals vary from the previous, and from the budgeted figures?

- How does actual performance in terms of volumes and revenues compare to budgeted volumes and revenues?

- How have the cost of goods sold changed, in contrast with the changes in revenue levels/sales performance?

- How have profit margins moved over quarters, over financial periods and within different revenue streams?

Looking into a variance analysis helps you gain deeper insights into business dynamics so that you can troubleshoot where necessary and adjust your forecast accordingly.

Who exactly monitors your 3-way forecast depends again on the purpose of the forecast. Operational 3-way forecasts will need to be seen by division managers, business unit heads and at the Board level, depending on reporting timeframes. Strategic 3-way forecasts for projects and new business units will remain under the scrutiny of project managers and owners. Lenders and investors will want updated 3-way forecasts of new projects and investments.

Forecasting for different scenarios

“Business is all about risk-taking and managing uncertainties and turbulence”, says Indian billionaire industrialist Gautam Adani. Forecasting is all about looking forward and trying to optimise business choices in an uncertain and turbulent environment.

Let us take some simple examples to demonstrate this idea:

- You would invest differently, and in different investing options depending on whether interest rates are 2%, 10% or 20%.

- As a consumer you would spend money differently and change your borrowing and spending patterns depending on whether inflation is 5%, 10% or 30% and what your salary growth rates are likely to be.

- Businesses will change their expansion plans depending on whether an economy is growing at 3%, 10% or 15% and what borrowing costs are.

This is why forecasting for different scenarios—with different business factors, changing assumptions and varying potential results—makes a difference for business decision-makers. Business resilience is built on the ability to survive a wider range of changing factors in the business environment.

Leverage features of MODLR for 3-way forecast success

- Automate 3-way forecasting with MODLR. MODLR is popular among finance professionals and business users because it helps automate manual tasks in accounting, budgeting, business planning and business modelling which were previously performed using Excel. It helps free up the time of finance professionals for analysis and interpretation of results and projections, instead of being buried under an avalanche of multiple versions of Excel sheets. This versatility and economy that comes from the automation of routine tasks can easily be leveraged for the preparation of 3-way forecasts.

- Easily import financial statements from various sources. MODLR offers an integrated platform into which you can import financial statements from a wide range of sources, including ERP or accounting programmes such as MYOB, Xero, Quickbooks, Sage, Netsuite, and SAP, among others. Once they are all on the versatile MODLR platform, you can easily run your 3-way forecasting model.

- Use real-time data flows with MODLR’s connectors. This ensures that your cash flow reports are always up-to-date. You can also create a workflow to get them sent directly to your inbox.

- Use MODLR’s web-based modelling tool for faster decision-making. This powerful tool enables easy sharing and smooth collaboration. You can invite all relevant stakeholders and drive faster decision-making, sharpening the competitive edge of your business.

- MODLR’s versatile dashboards and reporting capabilities. MODLR dashboard visually highlights trouble spots and issues in your forecast. Identify cash shortages and surpluses; see results of variance analyses; compare projected performance with past results; identify trends. You can use the MODLR dashboard to quickly identify potential issues and opportunities so that you can finetune your 3-way forecast and business statements.

- Use scenario and ‘what if’ modelling. In an uncertain world, planning for different potential scenarios and taking a proactive stance on potential future events will make your business plans more robust. You can use MODLR’s scenario-based ‘what if’ modelling and analytical features to be better prepared. You can easily create projections and 3-way forecasts for multiple scenarios, by changing your assumptions and for different parameters and comparing them side-by-side.

- Perform group business consolidations with ease. Whether you have two business entities or 50, MODLR’s versatile and automated models perform multi-company consolidations with ease. You can produce consolidated group financial statements and consolidated 3-way forecasts with speed and accuracy.

Schedule a demo of MODLR's 3-way forecasting solution

To see the MODLR Cloud in action and discover its 3-way forecasting solution for yourself, schedule a demo here.