Bottom Up Budgeting vs. Top Down Budgeting

The bottom-up and top-down budgeting are the two most widely used budgeting approaches in the business world and in other sectors. This guide compares and contrasts top-down budgeting and bottom-up budgeting processes so that you can select the one that suits your business needs best.

A budget creates a road map to follow to achieve your strategic business objectives. Although you can run a business without budgeting, it is not a route to business success. Skipping the entire budgeting process—whether top-down, bottom-up or otherwise—means you run the risk of cash flow problems, overspending and lack of attention to key business areas. Working without a budget increases business risk and invites potential business crises. And you may end up spending extra time on fire fighting. The end result may not be pretty. You may lose customers and stunting business growth at best and ruin your business at worst.

We invite you to explore this guide on bottom-up and top-down budgeting so you can select the approach that suits you best. We have discussed the pros and cons of the two approaches and which approach suits which business sizes and circumstances. We have also looked at the challenges faced by budgeters and how MODLR can support your budgeting process by making it faster, smoother and more effective.

- What are the Benefits of Budgeting?

- What is Top-Down Budgeting?

- Top-Down Budgeting Pros and Cons

- What is Bottom-Up Budgeting?

- Pros and Cons of Bottom-Up Budgets

- Which Is Better - Bottom-Up Budgeting or Top-Down Budgeting?

- Budgetary Approach - How Business Size and Structure Matters

- An Alternative Approach: Zero Based budgeting

- Overcoming budgeting challenges

- MODLR Makes Planning and Budgeting So Much Easier

- Want to see MODLR's Financial Planning and Analytics solutions in action?

What are the Benefits of Budgeting?

Budgeting makes managers think through decisions and leads to better business outcomes.

No one would advise an entrepreneur to start a business without a viable business plan. This is why banks and investors always ask for business plans. The benefit of a business plan is not just the figures that are included in it. The process of methodically thinking through how the business operates, how revenues arise, and potential cash inflows and outflows make an entrepreneur more attuned to how their business operates. The process of business planning makes the business more robust. It helps reduce the potential of unforeseen consequences of business decisions.

The same logic applies to preparation of annual and other periodic budgets. The managers and executives who are responsible for generating revenue streams and keeping costs within control and maintaining profit margins get a reminder about the challenges they face as they conduct business operations. The insight that is gained from the budgeting process is useful for working towards achieving business goals.

The same is useful in the communication and collaboration processes that take place when company leadership teams and departments down the line negotiate their annual budgets. These negotiations make everyone think. They help understand business opportunities and challenges. The collective thinking process that is budgeting helps companies come up with growth strategies and ways to meet constant business challenges.

Budgets increase efficiency of business operations.

In putting together a budget, you need to look beyond the day to day concerns of running business operations and take time to focus on the long-term growth and health of your business.

Operational managers can use their budgets as a roadmap to organize their daily, weekly, monthly and seasonal operations. With a budget in hand, no one needs to say they must get extra stocks and extra people during holidays or prepare for extra manpower during seasons of high demand.

On the other hand, businesses can schedule their periodic maintenance which requires plant shutdowns to happen during slow business seasons. Just the process of creating a budget, looking at the entire year, month by month, highlights these needs down the road. And doing so helps create more accurate budget figures enabling for more efficient business operations.

Budgets help you plan for profits.

Businesses are there to generate profits for their shareholders, not just to serve their customers. While top level leaders may not ever forget this fact, managers down the line get a reminder of this fact when the budgeting process begins. Setting a Making budgets helps you take a realistic look at potentially attainable revenue levels month by month and what expenses need to be met in achieving those revenues. In addition to all known expenses. managers must also budget for contingencies and unexpected cost elements and cost increases that may need to be met. Taking a closer look at these figures month by month helps managers focus on what levels of revenue must be achieved in order to generate profits on a monthly basis.

For example, with bottom up-budgeting, if you know that the regular monthly cost of running your department is $25,000, and each manager is expected to generate a profit margin of 10% then your department needs to generate a profit of at least $2,500. To do so the department must achieve revenues of at least $27,500 for that month.

If you operate in a top-down budgeting company, you would be told you need to achieve $35,000 a month in revenues and a certain level of revenue at the end of the year. If you are also going to be held to a minimum profit margin of 10%, this means that you need to keep your costs below $35,000 in that month. So your budgeting must look at how you can achieve such levels of revenue while also keeping your costs within budget.

Budgets are a key supporting tool for good business management.

The business leaders and executives are stewards of a business and work on behalf of its owners. In larger businesses the owners are not part of the management team. But whether a company is large or small, the process of coming up with annual, five-year and longer term plans are key for business success. Implementing these plans help lead a business into a successful future with growth and profits.

Budgeting is a way to help translate those long term plans into action. When they are laid out carefully, in terms of annual, seasonal, monthly and weekly performance budgets, managers and their teams can focus on achieving those targets by putting in consistent effort on a regular basis. That is how budgeting becomes an essential road map to success and a necessary tool for good business management.

Top-Down Budgets vs. Bottom-Up Budgets

Top-down and bottom-up budgeting are the most frequently used budgeting approaches in modern businesses.

In top-down budgeting, the senior leadership of a company or group provides the parameters within which departments and business units in— groups and diversified firms—must follow when generating their budgets.

In contrast, bottom-up budgeting requires departments and business units to come up with their own budgets and estimates for review and approval by senior leadership.

Each of these approaches has its own advantages and disadvantages.

What is Top-Down Budgeting?

Top-down budgeting is an approach to budgeting where the executive leadership teams and senior managers determine high -level budget parameters based on a company or group's business objectives. These parameters, once approved at a high level are passed on to—or pushed down—to departments and business units. The department heads then work with their teams to generate budgets according to leadership expectations.

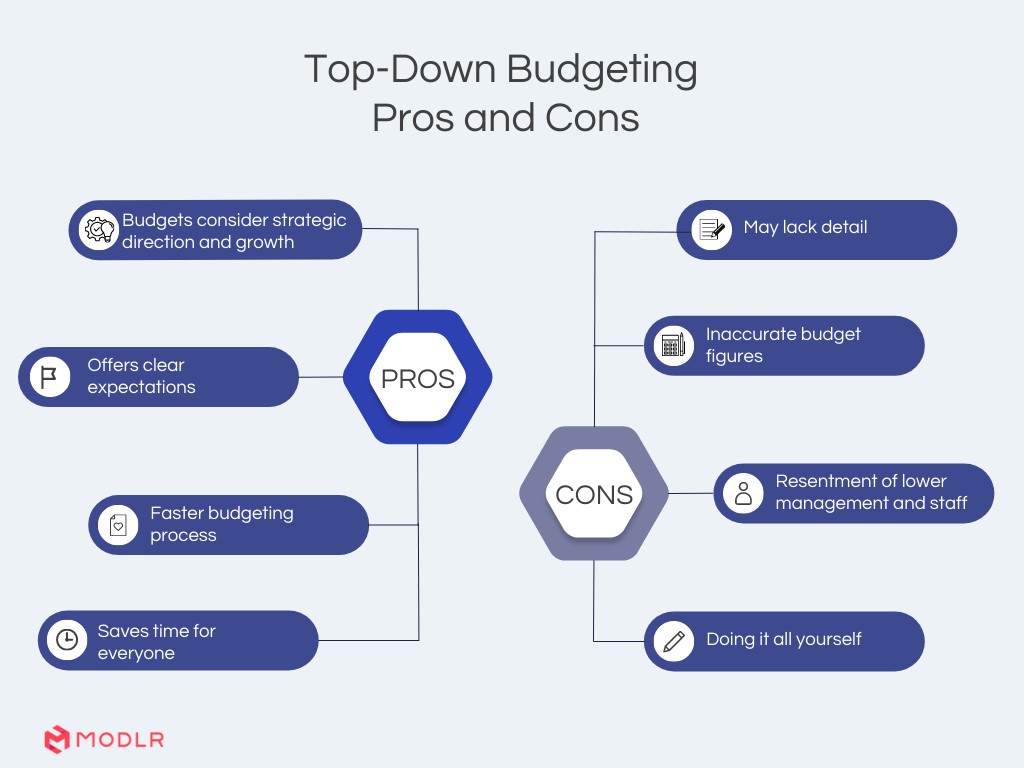

Top-Down Budgeting Pros and Cons

Advantages of Top-Down Budgeting

- The company leadership focuses on strategic direction and organisational growth when preparing top-down budget parameters.

- Since they operate at a strategic level, top-down budgets may not have enough detail.

- Top-down approach provides clear expectations to all departments and business units about their revenue targets and profitability.

- Top-down approach leads to a faster budgeting process.

- Quicker budgetary process saves time for both upper and lower level management

Disadvantages of Top-Down Budgeting

- Can lead to unrealistic budget figures since cost and performance (revenue) expectations are set by top leadership,

- May lead to resentment by lower management.

- Since they operate at a strategic level, top-down budgets may not have enough detail.

- Less accurate budget figures if a proper bottom-up and top-down reconciliation is not achieved before finalizing budgets.

What is Bottom-Up Budgeting?

In Bottom-Up budgeting it is the department heads and business unit heads who determine the budget parameters. Then they create their own budgets that are then forwarded for the review and approval of the senior and corporate leadership teams.

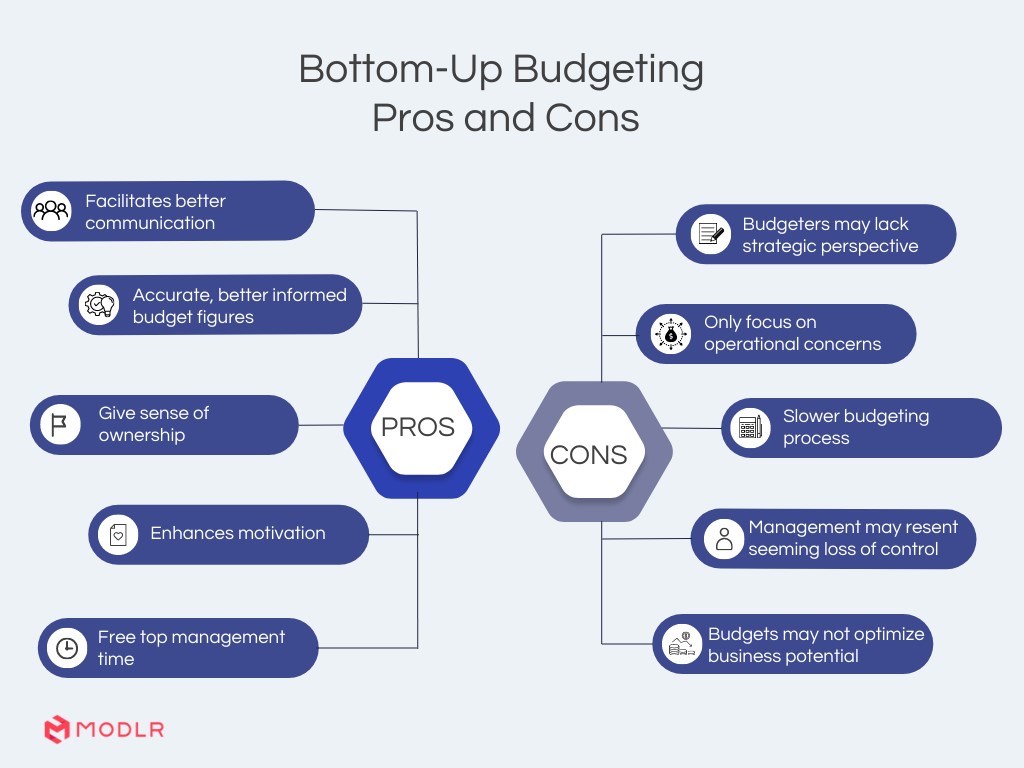

Pros and Cons of Bottom-Up Budgets

Advantages of Bottom Up Budgets

- The biggest advantage of bottom up budgeting is that it frees up top management time to enable them to focus on business strategy and direction.

- Enhances motivation and gives a sense of ownership to departments who must implement the budgets.

- Contain more accurate and better informed figures since bottom-up budgets are prepared by the employees of the respective departments who are responsible for meeting the budgets.

- Bottom-up budgeting also improves each department manager's understanding of their performance responsibilities and the commitment needed to achieve the budgeted figures.

- Facilitates better communication between and among departments with less stepping on others toes and more collaboration.

Disadvantages of Bottom-Up Budgets

- Departmental managers may lack the strategic perspective and may focus on the concerns of their departments and divisions. Dysfunctional budgets may result in a pure bottom up only approach to budgeting since the amalgamation of all top down budgets may not support the full realisation of corporate objectives.

- Senior leadership of the business may resent the lack of control over company direction.

- Inexperienced department managers may not prepare budgets that realise the full potential of the business divisions.

- Budget preparations may be slow. And disputes may arise at a later stage when all departments' budgets are put together due to boundary clashes.

- Managers may build in budgetary slack, which makes it easy for them to achieve their targets.

Which Is Better - Bottom-Up or Top-Down Budgeting?

The best approach for budgeting depends on each business, its size and its business structure. There is no one right answer to this question. Striking a logical balance between the two approaches can help companies make more optimal budgeting decisions.

Yes, budgeting over the long run needs to achieve long term strategic objectives and take the business in the strategic direction set out by the top leadership. However, budgetary buy-in and ownership of those leading the march at the front is also key to achieving the set budgets. Those who work directly on the frontline need to feel that they have made the decisions that they must implement. Using the top-down style tends to create a seemingly un-bridgeable distance between the top leadership and operational divisions and departments.

If a healthy balance is not found, the entire budgetary process can undermine the motivation across the company. Dissatisfaction with the process, feeling their ideas and concerns are not being heard and the inability to perform to unrealistically high expectations can lead to lower productivity. These can also lead to lower engagement in work, higher absenteeism and staff turnover.

Poorly-informed decisions made by top leadership without regard for operational teams' inputs, concerns and feedback are not doing any favours to a company's future growth and profitability. This is why the best and most healthy way to budgeting is a compromise between the top-down and bottom-up approaches.

The top management team can convey the desired strategic direction and offer guidance on what broad expectations need to be met by budgeting teams.

The department and business unit heads then need to translate those broad targets into operationally realistic and achievable budget figures. This necessarily calls for collaboration and compromise from both top and bottom and throughout the organisational hierarchy.

Budgetary Approach - How Business Size and Structure Matters

Larger businesses with many levels of management and diversified business structures will find that bottom-up budgeting works best. This is because the top management team is unable to offer a level of detail and expertise required for successful top-down budgets. Instead, the top leadership can offer broad strategic guidance and direction to help those at departmental level make budgetary decisions. In such diversified firms, top leadership teams will find that bottom up budgeting offers them much insight and a level of detail about the various business units of the company.

Smaller companies, with fewer layers of management can effectively use the top-down budgetary approach, especially where the leadership team is also involved at the operational level.

In startups and entrepreneur-led businesses, bottom-up and top-down approaches become one and the same, bringing together the best of both. However, the smaller businesses and entrepreneurs need to avoid groupthink. They must take precautions to avoid suboptimal decisions in their long term and operational budgeting that would compromise strategic business growth and potential.

An Alternative Approach: Zero Based Budgeting

Zero-based budgeting (ZBB) is another approach to budgeting where instead of beginning the budget process with previous figures, the managers begin with a clean slate.

The main implication of the zero base is that all expenses need to be justified every budget period. Zero based budgeting approach helps to highlight and eliminate unproductive expenses. Only the essential and result-generating expense elements get included in the budget.

In order to do so, managers in every function and operational unit—and those not in profit centers as well—need to give a fresh look into their operations and analyse their needs and their costs. Budgeted revenues are based on the needs and potential achievements for the upcoming period, be it week, month or year. The budgeted expenses are tailored to meet the revenue generating activities budgeted for that period.

In contrast to traditional budgeting,which takes an incremental approach to projecting revenues and expenses, zero based budgeting takes nothing for granted. Zero-based budgeting can help make business operations leaner and improve profitability. However, long term investment projects with their long range revenue prospects need to be protected and treated carefully in a zero based environment. Potential avenues of revenue for the future should not be sacrificed at the altar of short term profits and profitability and discontinued in a zero based frenzy.

Overcoming Budgeting Challenges

Whatever the budgeting approach you choose—bottom up, top down or zero based budgeting or a combination—you will need to get both financial and operational data from multiple divisions and units across the company and group into one coherent document. And then you must repeat this all over again after each round of budget discussions and update the integrated document for changes and adjustments.

Software can make a difference

Budgeting can be a relatively lengthy process, and the software we use can make it even longer.

- Frustrating and time consuming. Putting together a multitude of spreadsheets from different divisions can be a mind numbing, hair pulling type of frustrating task. It is part of what we call “Excel Hell” that we want MODLR users to avoid. .

- Templates, who cares, right? Yes, only you care. Everyone else will just make changes to your templates, making the automation of data integration difficult if not impossible.

- Primary data sources cannot be integrated. If your people use info from various sources, and all those do not lend themselves to easy integration, you are in trouble.

- Connectivity issues and access issues. Even if you use software that is available company wide, not all your teams can login and work on their budgets at the same time.

- Forget about real time variance analyses that you need to do to get your budget figures right. They are not possible with some software, and frankly, too much of a hassle on most software.

- Sometimes you need to re-enter everything. Yes, this happens. And then all those typos creep in. And you need to spend valuable time to unravel that.

- Other complications. If someone wants to run scenarios on their revenue models and new projects, they have to do that separately. And then comes all the integration issues again, And you can't incorporate all that into Excel anyway.

If that sounds like a whole depressing scenario, you are right. But similar scenarios are being played out across the world in many businesses. That is the reality.

Things can be different! We, at MODLR, have tried to make things different.

MODLR users are able to avoid all the hassles and frustrations. MODLR on the cloud liberates them to actually spend their time doing what they do best, financial analyses, reporting and decision support activities.

MODLR Makes Planning and Budgeting So Much Easier

In short, fewer people can do more things when you are working with MODLR.

Here’s what makes the difference:

MODLR's advanced planning and forecasting tools

A comprehensive set of budgeting, planning and forecasting tools make things easier and speeds up the budgeting process.

- Simultaneous login to work together collaboratively from wherever they are in the world can make the budgeting easy and smooth.

- Everyone is on the same page with MODLR. Being able to see the same data from anywhere helps run budget meetings quickly and efficiently. Meetings and discussions move faster, with little frustration since everyone can see the same reports and can easily tell whether their changes have been incorporated.

- Shortens the budgeting process. Revised budgets are ready as soon as the new inputs enter the system making budgeting so much quicker and more efficient. There’s no need to wait to integrate disparate data files, a process which is extremely time consuming.

- See all budgets in one model. One of MODLR's strengths is in holding all budgets in one model so that all planning managers are able to see their "patch" of the business. They can make changes which all add together and consolidate for the benefit of the senior management in real-time.

- MODLR brings together data from third-party data sources into a single source of truth. The value of this is only appreciated by those who have tried it and have run into problems. Did you know, for instance, that inability to successfully integrate data sources is a key obstacle for the progress of digital transformation in many firms?

- Comparative analysis with unlimited what-if scenarios empowers MODLR users to build and model scenarios to answer questions about impact of various decisions. Sophisticated tools that require no coding expertise leads to faster analysis of potential business scenarios so that informed business decisions can be made, instead of relying on guesswork.

- Use your actuals for guidance. MODLR makes it easy to review actuals such as historical spend levels during the budgeting process. An automated the flow of actuals from accounting systems (ERPs) support making of formula driven plans like rolling forecasts and driver based budgets.

- Variance analyses are quick, easy and comprehensive with MODLR. Past variance analyses are easy to access. And the reasons and explanations for significant variances can be included within the analyses for future reference. Budgeters can access these to avoid repeating suboptimal decisions. Read our article on How to Do a Month-End Variance Analysis for Your Business

- Forecasting is easier on MODLR. Want to perform 3-way forecasting? Read our article on 3-way forecasting to know what features of MODLR make it go smoothly.

Fast modelling and prototyping with no limits on scalability.

- Big or small MODLR can handle your models and scenarios efficiently. Proposed changes can be incorporated on the fly, if needed, adding new scenarios and variables.

- MODLR's free-form modelling for unique business needs enables users to take budgeting and planning — especially strategic and long range planning and investment decision making—to a whole new level. Also, you do your project modelling on MODLR, using the same info that you use for regular business reporting. There is no need to struggle with integrations or to re enter data because it is available at your fingertips.

- Ease of use. You don’t need to be a financial modelling wizard to begging working on modelling with the MODLR platform.

Large scale, multi-site, collaborative planning

When your people are working across multiple sites—some working from home, and others joining in from around the country and world—great collaborative tools are a must. MODLR offers a suite of collaborative tools to get budgeting and planning tasks completed quickly and easily. MODLR on the cloud enables any number of users from your company to login simultaneously and work on the tasks they are assigned to do without access limitations or restrictions.

Interactive management dashboards and scorecards

MODLR’s interactive dashboards and scorecards support management decision making, including your periodic budgeting process.

- Ease of access. Everyone, within their individual access levels, can login and access their own dashboards.

- Dashboards you can tailor to your needs. You can also tailor them for your specific needs. This brings the budgeting and planning process more real, up close and personal. This surely fosters better engagement.

- Monitoring progress is easier on MODLR dashboards. At meetings or on your own, leaders and team members can monitor progress in real time. MODLR’s user friendly dashboards help you interpret the data in front of you, making it more real and relatable to your job responsibilities.

Data security is assured on the MODLR platform

Your data integrity is secured with advanced access tagging and audit trails for all changes made to the system.

Use MODLR to automate period-end procedures

You can automate all your routine time-consuming tasks in budgeting and planning with MODLR, enhancing employee efficiency as well as satisfaction.

- Generates financial statements

- Automate financial consolidations

- Set up automatic period end journaling

- Quick variance analyses that can record discussion inputs

The bottom line is that, the more complicated the process—be it variance analyses, business forecasting or modelling scenarios—the easier it becomes with MODLR. It offers a welcome change for those struggling with jungles of Excel worksheets. MODLR is also a step ahead of most proprietary software in terms of unlimited, scalable cloud access for large, multi-site collaborative projects. And it makes integration of data from multiple sources efficient and effective.

Want to see MODLR's Financial Planning and Analytics solutions in action?

Regardless of whether you plan to use top down budgeting or bottom up budgeting, you can make life so much easier by using the MODLR platforms. If you are interested in learning more about MODLR and finding out how the CPM Cloud can support your organization management decision and operational processes go ahead and schedule a demo here today.