How Rolling Forecasts Can Help Improve Business Performance

- Introduction

- What is a forecast?

- Uses of forecasting in a business

- What is a rolling forecast?

- The pros and cons of the rolling forecasting technique

- Advantages of rolling forecasts

- Rolling forecasts offer visibility over a full planning period.

- Rolling forecasts consider the most updated performance and results.

- Rolling forecasts can consider changes in the business environment.

- Rolling forecasts enable businesses to be more agile.

- Rolling forecasts are enablers of business profitability and sustainability.

- Disadvantages of rolling forecasts

- Advantages of rolling forecasts

- Practical considerations in making a rolling forecasts and how MODLR can help

- Rolling forecast Q&A

- Q: What factors should we consider before using rolling forecasts in our business?

- Q: Do rolling forecasts make sense in a cost trimming lean business environment?

- Q. Is it worthwhile shifting to rolling forecasts?

- Q: Will adopting the rolling forecast method reduce the costs of continuing the practice?

- Q: Tell me more about MODLR sale forecasting solutions

- MODLR Solutions for Modern Businesses

Introduction

Do you use forecasting? If you really think about it, virtually all routine business decisions are likely to be based on some type of forecast. This article introduces the method of rolling forecasts, as an alternative to static forecasting techniques. It explains how rolling forecasting can be used to improve business results and performance and discusses the pros and cons and practical considerations for making rolling business forecasts.

Adopting rolling forecasts enables your business to become agile, and adapt to rapid, continuous changes that are the norm today in the world of business. Rolling forecasts empower business leaders and executives to be dynamic and innovative in responding to changes in order to gain and retain a competitive advantage over their rivals.

What is a forecast?

A forecast is a prediction about the future that uses historical or past data as inputs in order to make informed estimates of what is likely to happen. There are many ways to forecast business activities and performance and rolling forecasts are just one technique in the forecasting tool box.

Types of forecasting

Forecasting techniques can be divided into three main types: Qualitative forecasts, quantitative forecasts that use projections and time series, and causal forecasting.

- Qualitative forecasting uses qualitative data, instead of merely numbers. They rely on expert opinions and other means to derive information concerning events in the business environment that may impact your business. They may or may not consider past data in the forecasting process.

- Historical data-based (Driver based) forecasting focuses fully on patterns and pattern changes over time. These forecasting techniques count on projections and time series analyses of things that occurred in the past to predict patterns that may happen in the future.

- Casual models of forecasting also depend to a degree on the past and make use of specific and highly refined information that considers relationships between various system elements.

Rolling forecasts are an example of forecasting techniques that rely on what happened in the past as a means of predicting the future.

Static and rolling forecasts

Static forecasting is performed for a given period, say five years, every year or quarter by quarter (every three months) or for shorter periods, like a month.

Let us say you make an annual forecast with the static approach. With annual forecasting, operational executives have in their hands the budgets and forecasts for 2023. But as the year draws to a close, say by October 2023, you will only have two more months of forecasts in hand with the static budgeting approach. There is nothing for the month of January and beyond because that forecast will only come when the annual forecasting process is completed for 2024. This poses planning problems when making decisions that may have ongoing implications beyond the current year. With static forecasting, the decision makers are running half blind most of the time.

With a 12 month rolling forecast, after every month is over, a new month's forecast will be added to the end of the forecast period. For example, when January 2023 comes to an end, you will have January 2024 added on to the front of your rolling forecast. With rolling forecasts, planning and implementing those plans become easier because you will always have forecasts that go 12 months into the future.

Uses of forecasting in a business

Forecasting techniques are used for many purposes within a company. All of them may benefit from the rolling forecasting technique.

- A general business forecast will predict the direction of the business and how it will perform over a given future period.

- Financial forecasting involves looking at how the profit and loss accounts, the balance sheet and the cash flow statement of a business will evolve with the business' performance.

- Accounting forecasts go into deeper details about how various aspects of the business will impact different aspects of the business over time.

- Demand forecasting looks at how the demand for products and services of a business will move over time.

- Sales and marketing forecasts look at how the business meets that demand and turns them into sales. Marketing and sales forecasting also takes into account the many marketing and promotional activities and how they are expected to impact sales forecasts.

- Human resource forecasts are about how many people with different types of skills and expertise are needed to carry on business operations.

- Supply chain forecasts consider the material and service needs to align with manufacturing (operational) and service forecasts and capital procurements.

- Capital forecasting is the process of predicting how much funds are needed for ongoing business operations and for making investments for the future.

If you look at it, all of these different aspects of a company are closely interlinked. If you want to run a smooth business, your forecasts for the different aspects need to smoothly align and dovetail against each other. Because if they don't, there will be trouble.

For example, there is no point in making financial forecasts, sales and operational forecasts or HR forecasts for a new manufacturing facility or service unit becoming operational in a given period if a capital forecast for the same period has not been made. If this is the case, there will be no funds to invest to get the project off the ground and begin operations.

What is a rolling forecast?

Let's take a look at how rolling forecasts roll.

Defining a rolling forecast

Rolling forecasts are predictions of future numbers that are performed continuously over a period of time, based on historical data and drivers.

In contrast with static annual forecasting, rolling forecasting allows for continuous planning and some semblance of visibility into the future beyond the current forecasting period.

How the time frame of a rolling forecast compares with static forecast

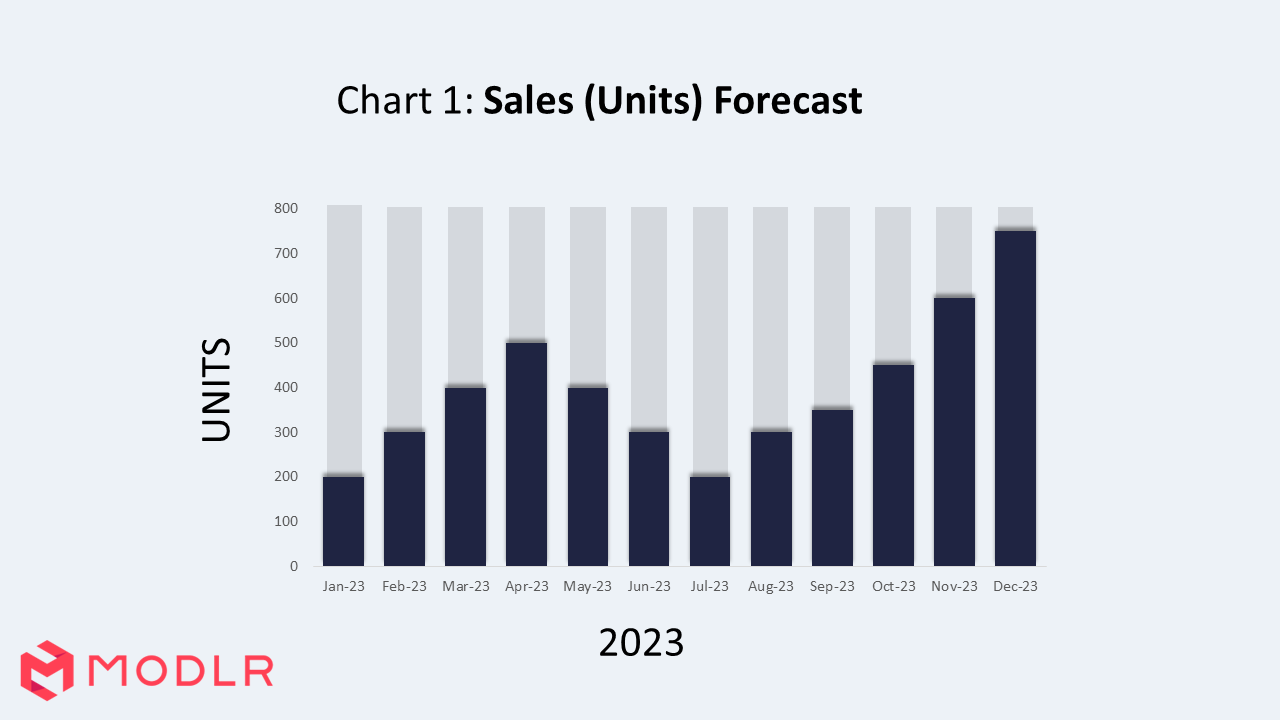

For a new business, the forecasts will look the same (See Chart 1) at the beginning of the year 2023, whether you are adopting static budgeting or are using rolling forecasts.

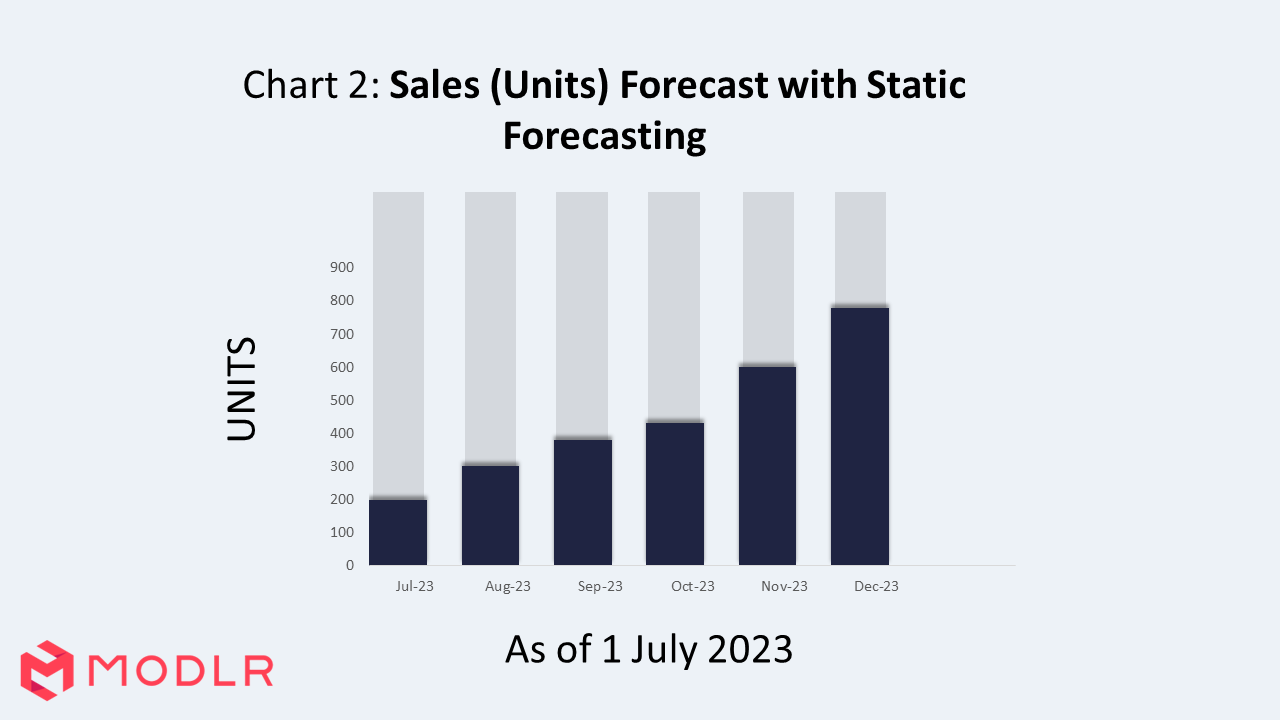

Halfway through the year, by July, Chart 2 shows what the sales forecast looks like, if a company is into static budgeting. You have to plan for the next year with no idea of how things will develop into the future.

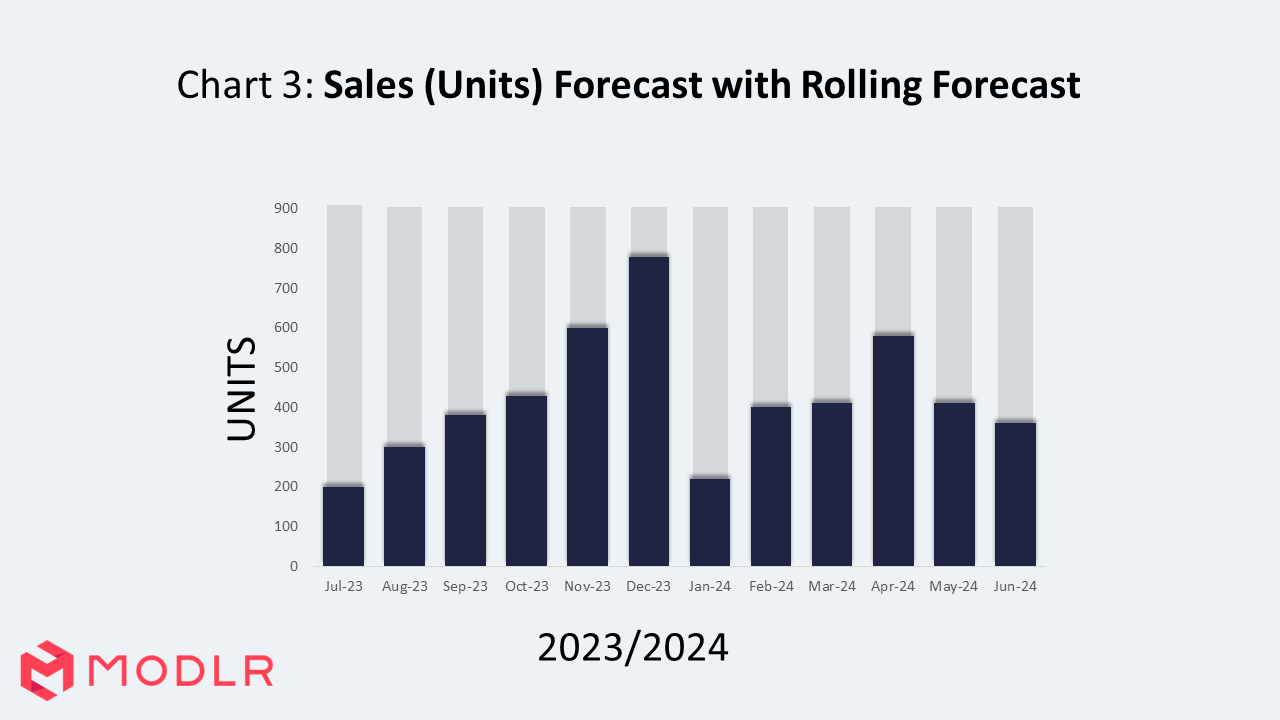

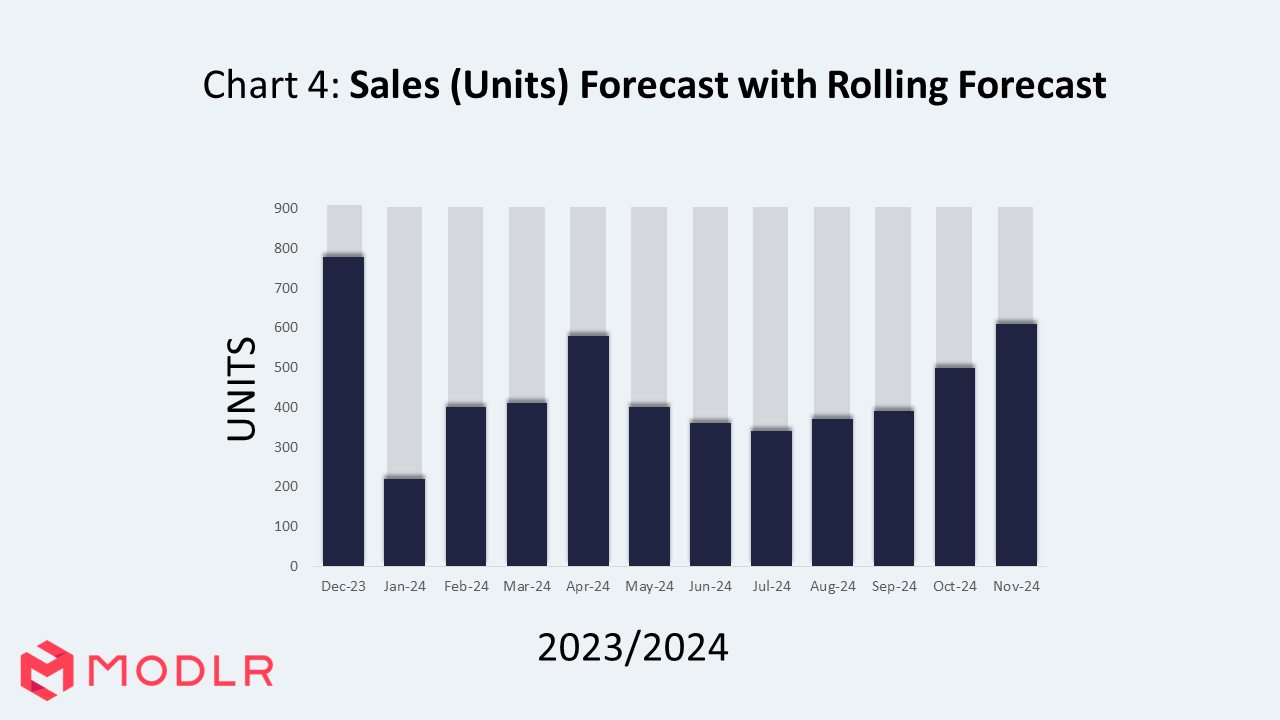

In contrast, Charts 3 and 4 clearly demonstrate what the sales forecasts will look like in July 2023 and at the end of November 2023 when adopting the rolling forecast method. The planner can clearly prepare better for the future as they can see ahead up to an entire year at any point in time.

Putting the driver in Driver-based Rolling Forecasts

A significant factor in Rolling Forecasts is determining the correct drivers for specific account groupings. i.e. "How does the professional development account calculate its forecast amount for each month of the rolling forecast projection?". For steady and straightforward accounts which do not have much seasonality in their actuals, it may make sense to simply roll forward the last year spend + inflation for a driverless forecast. In the majority of cases, we would design a set of re-usable drivers such as "Rate per Headcount" which would calculate historically what the cost of this account group, per employee has been, and would then project this forward (with inflation) over the forecast period based on the driver (Headcount) which would need to have been planned first.

The final setup step is to work through the accounts of the profit and loss, assigning drivers or driverless phasing methods to each of the accounts. This will then drive a fully automated rolling forecast projection for each account consolidating into a full profit and loss view. Drivers can then be adjusted to calculate multiple differing scenarios for comparative what-if analysis.

Here are some examples of retail rolling forecast drivers we've seen regularly feature in rolling forecast models, followed by some driverless phasing methods.

Basic examples of drivers of financial outcomes in retail:

- Units Sold

- Units Produced

- Units Manufactured

- Trading Days

- Customer Count

- Website Unique Visitors

- Website Unique Pageviews

- Campaign Emails Sent

- Campaign SMS Sent

- Stock on Hand

- Office or Store Square Meterage

- Total Headcount

- Total FTE

Driverless phasing methods:

- Even Phasing

- Calendar Days

- Working Days

- Seasonal Projection

The pros and cons of the rolling forecasting technique

As with every tool, rolling forecasts also have their advantages and disadvantages. What businesses should try to do is to understand these pros and cons and try to balance them in order to get the best out of the technique.

Advantages of rolling forecasts

Rolling forecasts offer visibility over a full planning period.

Whether it is five years, one year or a quarter, budgeters, planners and decision makers always have visibility for a full planning period with rolling forecasts. Static forecasting and budgeting may leave planners with uncertainty, as demonstrated in Charts 3 and 4 above, especially towards the end of a planning period.

Rolling forecasts consider the most updated performance and results.

Rolling forecasts take into consideration the most recent monthly results in extending the forecast into the future. This is useful for future planning. It is critical to consider what happened in January 2023 when planning for January 2024, especially for those with seasonal business patterns. When a rolling forecast is added for Jan 2024, at the end of Jan 2023, it is imperative that the factors that impact the rolling forecast are given due consideration.

Needless to say, it is also important for rolling forecasters to consider how January results, events and changes in the business environment impact all future planning periods, beginning with February 2023 onwards.

Rolling forecasts automatically consider changes in the business environment.

While static annual budgets and forecasts will not take into account the ongoing changes until the next year's budgeting process begins, rolling forecasters have the advantage of fully considering the implications of various adverse and beneficial changes that take place in the business environment. As a result, rolling budgets are as good and up to date as planners can expect them to be.

Rolling forecasts enable businesses to be more agile.

Agility is a critical element for business success in a world that is becoming more volatile, uncertain, complex and ambiguous (or VUCA). Technological, social, cultural and even political forces are disrupting our tried and tested business models and making businesses more vulnerable to their effects. Static budgeting is the exact opposite of what you need to succeed in such a world. Rolling forecasts, done right, considering the latest changes in the business environment, together with strategic vision, will help a business be more agile and ready to take on a changing world.

Rolling forecasts are enablers of business profitability and sustainability.

At the end of the day (or shall we say planning period), what matters is that decision makers and executives who make things happen in a business are armed with the most up-to-date business information to carry on their work. And rolling forecasts are part of that. Without rolling forecasts, the decision makers are running half blind, half of the time, and unable to make the business as agile as it needs to be. In other words, rolling forecasts are enablers of business profitability and sustainability.

Disadvantages of rolling forecasts

To summarise disadvantages of rolling forecasts, you can say they take more time and are more complex than static forecasting. And therefore, rolling forecasts can also cost more money to implement on an ongoing basis. Let us look at how these disadvantages occur.

Rolling forecasts require more time and effort to setup, compared to static forecasting.

Time is money for a business. In a typical business, time is also a precious commodity for finance staff who are responsible for many other functions besides forecasting.

Rolling forecast require significant setup time in analysis to determine the best drivers per each account grouping, as getting this initial step wrong can significantly affect the accuracy of generated forecasts down the line.

Static budgeting and forecasting are initially easier to setup because you can work from templates alone, however each new forecast has you starting again from scratch.

Rolling forecasting process can be complex.

As with any other type of forecast, rolling forecasts especially will take into consideration factors in the business environment and internal business drivers that will affect business performance.

For example, interest rates, inflation, new taxes and other relevant factors need to be factored into a rolling forecast. It is important to find out how the sales volumes of a company can be impacted by rising or falling interest rates, new taxes on incomes or value added taxes. How will changes like these impact your buyers and their purchase volumes? How do foreign exchange rates for imported material inputs influence your cost of goods and therefore profitability? How does strengthening of the Australian dollar against your overseas markets impact your revenues and profitability?

How will consumers change their behavior in times of rising inflation? Can that impact your business sales? Will you need to drop prices or offer promotions? All of these factors need to be considered when making various business and operational forecasts that we discussed earlier.

Naturally, doing all this, on an ongoing basis will generate rolling forecasts derived from an aggregate of drivers which can then be complex to understand. But some features in MODLR will help make things simpler, and help you get your rolling forecasts done faster whilst isolating the impact of specific drivers for segmented reporting both at the planning stage and execution.

Obtaining information from external data sources can be difficult and time consuming

Obtaining information from external data sources is an imperative to dynamic rolling forecasters. Much time and effort needs to be invested to get the right information from the right sources. Once found, integrating such data into your budgeting platforms can be a challenge. Once again, if you are preparing your rolling forecasts with MODLR as your platform, things can be more smoothly managed.

Practical considerations in making a rolling forecasts and how MODLR can help

No one says rolling forecasts are easy, simple and quick. All FP&A professionals appreciate the complex process that goes into making rolling forecasting a reality on an ongoing basis. However, some of that hassle, the complexity and the time investment can be minimised if you are using MODLR as your primary planning platform.

In the following paragraphs, we have explained how rolling forecasts work on MODLR, the performance cloud. In doing so, we hope that you get a deeper understanding of the process of building rolling forecasts and what that entails within your business, and for different functions.

How MODLR helps rolling forecasters

MODLR brings agility, accuracy and collaborative planning to the table. MODLR also enables multi-dimensional planning, including driver-based planning, with scenarios and timeframes.

While rolling forecasts can be used in any function across the business, for the purpose of demonstrating its uses and complexities, let us look at how rolling forecasts work in the sales function.

Sales forecasting is complex, whether you use rolling forecasts or its alternatives. Let us look at how sales forecasting with MODLR can help you get things done with speed, saving precious time of FP&A as well as sales and marketing professionals. Speed, accuracy and detailed analyses translate to better decision making, monitoring and sales performance.

How Sales forecasting with MODLR works

MODLR helps you create collaborative sales plans and rolling forecasts with speed.

You can cut forecasting and planning timelines because MODLR enables all forecasting stakeholders - the sales teams and their leaders, marketing teams as well as FP&A teams - to work on a single platform, from wherever they are. When inputs are in, MODLR then integrates department, team and user budgeting workflow on to one platform with ease. Unlike with Excel, you don't need to struggle with merging a host of worksheets into one common budgeting document, and repeat this gruelling, time consuming exercise after each budget meeting all over again. This feature in MODLR alone helps save a lot of time and hassle FP&A professionals go through when using Excel and speeds up the budgeting process.

MODLR helps create integrated sales forecasts with multiple factors.

You can create integrated rolling sales forecasts using historical sales performance, sales trends, seasonal patterns as well as third party data from multiple sources.

With MODLR’s versatile integration capabilities you could go beyond integrating historical sales with seasonal and other sales trends. You can also integrate more complex matters like foreign exchange rates, potential impact of sales promotions and relevant market information that impact your sales. Achieving the same complex models and results without MODLR would take a lot of time and require sophisticated modeling capabilities from your FP&A team. But MODLR reduces the complexity and cuts down the time needed to achieve superior sales forecasts. It ensures that the business, and your sales team is armed with a single source of truth for confidently forge ahead in achieving their sales targets.

MODLR helps build flexible driver-based plans and rolling forecasts.

Driver-based modelling or planning focuses on identifying the key business and value drivers of your organisation and then creating budgets and plans around those drivers.

In sales for example, it is possible for you to forecast your business revenues using key drivers like the number of sales reps you employ. When creating a driver based sales plan, you can vary factors like hiring, sales quotas, sales ramp as well as sales rep attrition rates in your company when generating the revenue output.

Needless to say, integrating such varied factors and performing rolling (or even static) budgeting would require significant time investment because of the sheer complexity of the process. However, thanks to MODLR’s sales forecasting solution, you can easily build driver-based rolling forecasts in no time.

Rolling forecasts take significantly more time investment compared to static forecasts. Using various features of MODLR helps you achieve your rolling forecasts on an ongoing basis with speed.

Benefits of using MODLR for your rolling sales forecasts

Using MODLR’s sales forecasting solutions to create your rolling forecasts can deliver many benefits.

- Equip decision makers, operational leaders and sales teams with reliable, accurate rolling forecasts that are updated in real-time to drive enterprise-wide collaboration.

- Motivate and empower sales teams by equipping them with real-time dashboards that present their performance and show individual and team impacts on company-wide revenue.

- Empower sales teams with data driven actionable insights. This helps sales leaders make well-informed operational decisions.

- Align your sales pipeline and forecast with individual, product-wise and team based sales quotas and revenue expectations. Knowing this level of detail helps sales teams and leaders gain a comprehensive understanding of the potential risks and opportunities they can take to drive sales performance.

- Shortening the forecasting cycle times. MODLR can save precious time of senior sales professionals by reducing time spent on creating sales territory and quota plans.

You can find out more about the MODLR Sales Forecasting Solutions in the Q&A section.

Rolling forecast Q&A

We've created a rolling forecast Q&A to help those who are interested in finding out more about the practical considerations of adopting rolling forecasts in their businesses.

Q: What factors should we consider before using rolling forecasts in our business?

As with any other change in business, it is necessary to carefully consider pros and cons and weigh the costs and benefits of changing your forecasting method before adopting rolling forecasts.

Here are some factors you need to consider before making the final decision:

- Benefits of rolling forecasts. Naturally, the first step is to weigh the costs and the benefits before making the transition. We have discussed the many benefits of rolling forecasting and its superiority over static forecasting in great detail above.

- Cost of the transition. You already know that rolling forecasts are more complex compared to static forecasting methods. They take longer and are more time consuming. They also draw upon external data sources, not merely historical forecasts and performance. All this translates to more time from your financial planning and analysis (FP&A) team and also operational teams in each planning period. They must also spend time periodically to update the rolling forecasts in order to get the best out of the transition.

- Practical considerations such as whether the time is right for a transition.

- How long will the transition take? This is a key consideration. You want to get it done smoothly without any delays in your forecasting timelines. Ideally, you'd expect the transition to be quick and painless.

- Will you need to have a parallel system with the previous method that overlaps the rolling forecasting approach before going live?

- Software, skills and time investment necessary for transitioning to rolling forecast approach.

Weighing the costs and benefits of the rolling forecast approach goes beyond looking at initial costs. You must also consider what additional time and therefore, recurrent costs are involved and how all of the above factors impact your business and its performance.

Q: Do rolling forecasts make sense in a cost trimming lean business environment?

A: The business environment is increasingly more volatile, uncertain, complex and ambiguous (VUCA). In a VUCA world, the more agile, adaptable companies that can respond to changes will triumph over the less agile competitors. Building business agility to succeed in a VUCA world requires an all-hands-on-deck mentality, across a company. All functions must pitch it to enable the company to move at speed in responding to changes in their business environment.

Business agility does not begin with operations. It begins with strategy. Business forecasting is a vital sub segment of financial planning and analysis. It forms the backbone of all strategic and operational decision making. So if a business wants to be responsive to changes, do the traditional static business forecasts and operational forecasts, most commonly performed one a year, suffice? Certainly not. You need business and operational forecasts that are updated for the latest market trends and developments in order to remain competitive.

This is why, even in a cost cutting environment, where companies are even trimming down their non operational functions, CFOs are looking to add FP&A team members. And they want to maximise the productivity of their operational teams at the same time.

Q. Is it worthwhile shifting to rolling forecasts?

A: To determine whether it is worthwhile shifting to rolling forecasting methods, you need to ask how much more time and how much more costs per year you need to get the best of the dynamic rolling forecast techniques.

The answer, of course, depends on you and your business.

If you employ the traditional means of performing rolling forecasts, using Excel worksheets and traditional accounting platforms for data sharing and compiling company-wide forecasts, it would require a lot more time and therefore, a lot more money each forecast period. However it does not have to be that way. Technology and FP&A software tools have evolved significantly over the past few years. So today, there are smarter ways of getting your rolling forecasts done, easily, quickly and naturally, at a lower cost. See MODLR Solutions for Modern Businesses.

Q: Will adopting the rolling forecast method reduce the costs of continuing the practice?

A: You would expect ongoing costs of rolling forecasts to be optimal. When you compare these ground realities with the many benefits of rolling forecasts, then it becomes an imperative to explore how exactly the new software platforms work.

Q: Tell me more about MODLR sale forecasting solutions

A: MODLR sales forecasting solutions enable you to achieve so much more, regardless of whether you are using the rolling forecasts or alternatives.

MODLR sales forecasting helps you:

- Monitor and review pipeline potential and increase accountability of sales representatives, while also detecting “sandbagging” and “overcommit” behaviours from team members. Team leads and other decision makers can continually maintain an accurate and up-to-date forecast from a single unified platform. There will be little or no delays in accessing sales performance data.

- Make sales forecasts across geography, products, accounts and on a more granular level, if needed. MODLR helps create sales forecasts by geography, time, product lines, and accounts. You may also delve deeper into the details by changing dimensions to analyse sales forecasts at any level of granularity. For example, you can get sales forecasts by product SKUs, city and state levels or groups of accounts in any selected vertical.

- Integrate data from your customer relationship management (CRM) system to build projections and analyse multiple outcomes. MODLR helps you automate data feeds from your CRM platforms, such as accounts, opportunities, and other objects to flow into your sales forecast models. Integrating this level of detail ensures that your sales pipelines always reflects the latest developments and ground conditions in your markets.

- Discover and analyse trends, changes, and patterns of sales forecasts over time. Using MODLR's sales forecasting solution, you can build time-based dashboards and determine key performance indicators (KPIs) for your sales function. For example, you can use sales funnel velocity, trending analytics, and seasonal variations, among many other relevant factors to integrate trends and patterns relevant to your sales performance.

- Conduct “What-if” scenario analyses. MODLR's sales forecasting solution enables sales leaders and planners to test various scenarios and business assumptions to view the financial implications of potential changes to business or economic conditions on sales performance. For example, how would an increase in cost of sales (say due to exchange rate movements) impact profitability, or how a pricing change impacts sales volumes. This feature in MODLR helps you be prepared for contingencies by creating contingency plans for challenges that lie ahead in future sales cycles.

- Use real-time dashboards to analyse sales and marketing performance. Your teams can make their own real-time sales dashboards and reports with data visualisations including charts, graphs, maps and so much more using MODLR's sales forecasting solution. With such a level of granularity, your sales leaders can analyse sales forecasts and performance metrics to uncover real-time, actionable insights and empower teams to improve performance.

- Create sales forecasting calculations with recognisable formulas. MODLR’s user-friendly formula editor can be used by your sales team to build familiar sales forecasting formulas to configure models. Transparency in how sales figures are arrived at helps boost the confidence of sales teams.

- Compare forecasts and increase accuracy by combining multiple modelling techniques. Rolling forecasts for sales are just one way you can use the MODLR sales forecasting solution. MODLR enables you to build sales forecasts formed from qualitative, time series analysis and projection, causal modelling techniques, and more.

- Enhance accuracy and cut down speed of forecasting by integrating MODLR platform with external solutions and data sources using pre-built connectors. You can easily integrate your forecasting with upstream or downstream systems using MODLR’s pre-built connectors to automate data flows, or, self-service import and export with MODLR’s Excel Add-in. Either way, you can get so much more done with less time and effort.

- Benefit from top security and smaller IT costs. Meddling with sales data is a constant danger. MODLR's role-based security, user management, and 2-factor authentication sign-in support ensures all information in your sales systems are protected through the highest-level of data security systems.

- Make performance management and future planning easy. MODLR makes historical sales data easily accessible. MODLR's effective version control and audit tracking enables historical sales forecasts to be accessible to all specified user groups for planning, monitoring and auditing purposes.

In this article we delved deep into the practice of rolling forecasts, exploring its pros and cons and practical considerations. We also attempted to show you how MODLR can help rolling forecasters overcome the traditional challenges that are inherent to making rolling forecasts to make it effective, quick and affordable as a business tool for everyday use.

MODLR Solutions for Modern Businesses

MODLR’s versatile features go beyond rolling forecasts for the sales function. We invite you to explore the various modules including MODLR’s Budgeting, Forecasting and Planning Solution, Workforce Planning Solution and the Financial Reporting Solution. [Request a demo].

MODLR's Budgeting, Forecasting and Planning Solution

Today's FP&A teams need software tools that enable them to perform agile, accurate and collaborative planning that helps the company compete effectively in ever-changing market conditions. Traditional spreadsheets appallingly fall short on this front leading to frustrations, bottlenecks and wasted time due to version control issues, data connectivity limitations, issues of integration, user limits and more.

MODLR’s Cloud Platform helps FP&A teams streamline their planning processes, build driver-based budgets at scale and create accurate forecasts. MODLR’s CPM Cloud enables companies to respond to shifting business environments with speed and agility by creating and implementing forward-looking plans and forecasts that are updated in real time.

Want to implement rolling forecasts across your business? Consider using MODLR's Budgeting, Forecasting and Planning Solution. [Request a demo].

MODLR's Workforce Planning Solution

Effective workforce planning is integral to business success. Yet, many companies are still struggling with error-prone spreadsheets in getting their workforce plans done.

Empower your workforce planners with MODLR's Workforce Planning solution and reduce the costs of the HR function. It delivers a connected platform where HR, Finance and executive leadership can gain an accurate, single source of truth into your organisation’s costs, workforce and workload. With MODLR for Workforce Planning, you can ensure that you deliver on all your performance goals and business strategy objectives by optimising your workforce resources to quickly respond to any changes in talent supply and market fluctuations.

If you are implementing rolling forecasts across the company, you will need a capable and versatile workforce planning solution that delivers results. [Request a demo].

MODLR's Financial Reporting Solution

Save the hassle and avoid the fatigue of having to constantly plug your financial reporting gaps from manual spreadsheets with disconnected ERPs, budgets and POS systems. MODLR’s financial reporting solution, enables you to create real-time, on-demand reports, “what-if’’ analyses and dashboards on budgets, forecasts and plans. MODLR saves you from the laborious, repetitive tasks that come with traditional spreadsheets; allowing you and your team to spend more time focusing on high-level strategic decisions to take your business further. [Request a demo].