- Introduction

- CFO Priorities for Leading in a Tough Economy

- Why Finance Automation Matters

- Take a Closer Look at Your Finance Function

- Where and How to Begin Finance Automation

- When Some Processes are Already Automated

- Doing Finance Automation Right - Best Practices

- Conclusion

- Get in Touch with Us

Introduction

Thriving in a downturn requires all divisions of a business, both operational and support, to work smarter, become more productive and tighten their belts. In most cases CEOs look at CFOs , the finance chiefs to lead this change. If companies need transformation, where should they begin? Before embarking on company-wide change projects, CFOs must get their own house in order, and prove beyond doubt that they and their teams have what it takes to lead business-wide transformations.

The Global Economy in a Sticky Spot was the title of the July 2024 World Economic Outlook (WEO) by the International Monetary Fund. In the most recent edition of the WEO, in October 2024, IMF says that “global growth is expected to remain broadly flat—decelerating from 3.3 percent in 2023 to 3.1 percent by 2029”, largely unchanged from the April 2024 forecast. When the global economy is in a sticky spot, all countries and businesses must also face the consequences. Australia and New Zealand are no exceptions.

Here’s what the present situation looks like:

-(2000-%C3%97-900-px)-(1500-%C3%97-1000-px)-(4).png)

Both Australia and New Zealand are expected to experience declines in GDP growth rates in 2024 compared to 2023. The good news on the horizon is that the year 2025 is expected to bring better news for both nations.

.png)

Source: International Monetary Fund, WEO October 2024

CFO Priorities for Leading in a Tough Economy

In the face of persistently high inflation and slowing down growth prospects CEOs, CFOs, CTOs and CHROs must grapple with crucial decisions on balancing competitiveness, profitability, staffing challenges and technology investments for future growth.

According to Gartner, globally, persistently high inflation and slowing down growth prospects finance chiefs’ top 5 priorities for 2024 include leading transformation efforts, evaluating of improving the strategy and design of the finance function, improving finance metrics, insights and storytelling, leading change management efforts while also optimising costs.

.png)

Source: Gartner

Although 2024 is drawing to a close, the global trends and economic forces that made them critical factors for business have only escalated. They will continue to remain priorities in 2025 as well, without doubt. You will be hard pressed to find a CEO or CFO who denies the importance of these factors to their business.

Modern CFOs strive and align closely with organisational priorities of the business. This inevitably means heightened pressure to contribute to overall profitable growth. In tough times, finding funds for technology investments, including for AI, becomes a priority. At the same time, talent shortages in critical capabilities areas puts pressure on CFOs to find means to improve retention, attract new talent, and develop inhouse talent while also dealing with rising wages and workforce productivity.

We, at MODLR, could not help but notice that we are well positioned to help CFOs deal effectively on all the priorities noted here. But, for now, let us focus on how automating the finance functions can improve efficiency and optimise costs for thriving in a downturn. All the rest of the priorities will get addressed once we can find workable and affordable ways to do that.

Why Finance Automation Matters

The decision to automate does not happen overnight. It is usually a result of the realisation that things can be better, more cost effective and faster. Often companies decide to automate in order to take their performance to a new level, and as part of an organisational transformation effort.

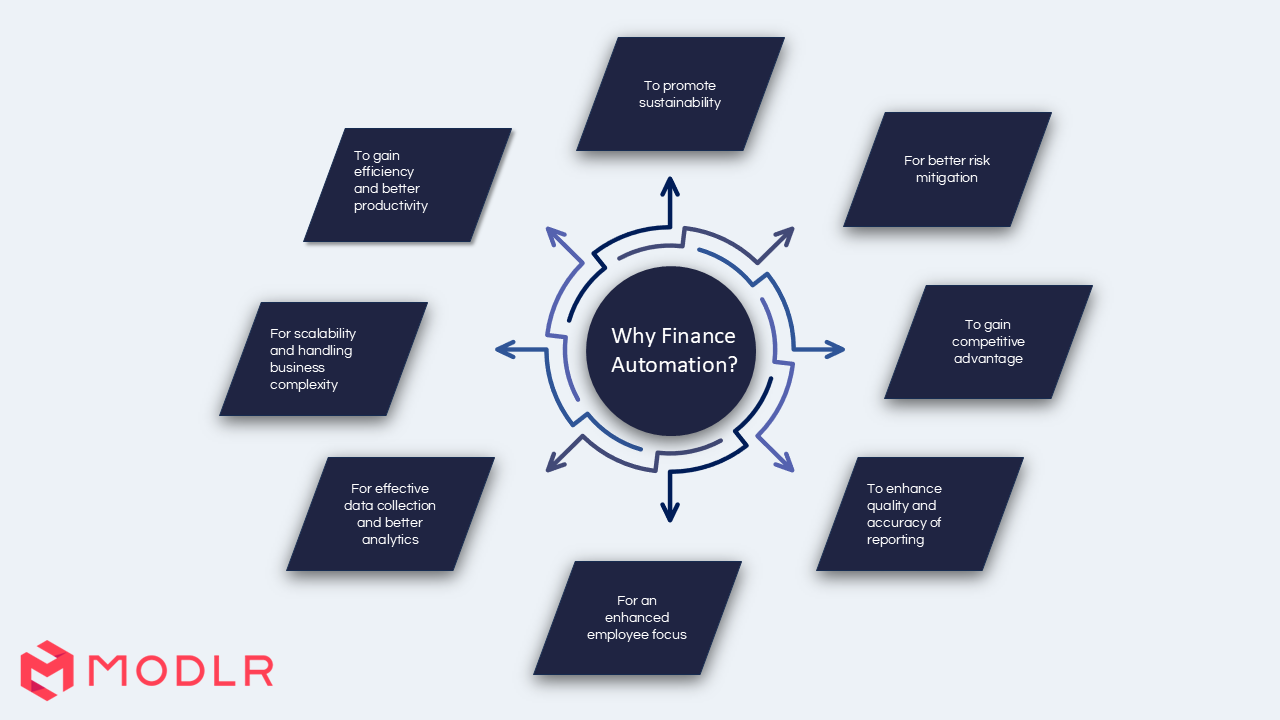

Finance chiefs look at automating finance with a variety of goals in mind.

To gain competitive advantage

An automated finance function is at the heart of a resilient growth business that can take calculated decisions with speed and execute them with agility. Companies that leverage automation can often outperform their competitors in terms of cost, speed, and quality, all of which can help them improve their market position. It makes sense for automation of processes to begin with the finance function.

To gain efficiency and better productivity

In times of economic stress, optimising the skills and talents of finance staff is key. Automation not only enables saving valuable skilled team members’ time for better uses, but also improves the quality of reporting and helps minimise errors.

For scalability and handling business complexity

An automated finance function can deal with business growth without significantly proportionate increases in the finance workforce. Automation helps deal with multiple business units, diverse locations for both routine reporting and period end consolidations.

For effective and quick data collection and better analytics

Automation enhances data collection and leads to better analytics. This paves way to improve the business’s preparedness and better decision making, leading to agility to deal with market changes and resilience over all.

To enhance quality, accuracy and speed of output

In terms of the finance function, most of the customers are internal stakeholders, including the Board of Directors, the CEO and the C-Suite and Division heads. Automation enables the Finance division to deliver higher quality reports with ease and speed, cutting down reporting cycle times in a big way. It is also possible to respond to one off queries with equal speed in an automated environment. Reports that took weeks to generate can be done within a couple of days. Queries can be promptly addressed without waiting hours and days.

For better risk mitigation

At the most basic level, one benefit of automating the finance function is minimising the effects of human error, thus reducing risk on many levels.

On a different level, the risk surface of a modern business is exponentially higher due to cloud exposure, internet enabled processes and widespread use of mobile and IT devices. This risk will only keep on growing. Automation, especially of risk assessment procedures, helps mitigate risks to the business. Automating processes for compliance monitoring and reporting also strengthens a company, enabling it to mitigate a variety of risks and avoid penalties.

For an enhanced employee focus

Millennials and Gen Z (iGen) that make up most of the workforce seek learning and career growth prospects in their jobs. Modern employees are less tolerant of mind numbing routine work that lacks excitement and potential for growth. Automation makes it easier to retain younger workers because it frees up their enabling them to focus on activities that add value, and call for creativity and critical thinking.

To promote sustainability

Automated finance systems can contribute to driving sustainability initiatives forward and support aligning financial performance with environmental responsibility in a number of ways.

- Efficiency and resource optimisation, including reduced paper use

- Better reporting and analysis to track environmental impact and sustainability metrics

- More environmentally conscious decision-making

- Enhanced compliance and environmental risk management

- Facilitating sustainable investment decisions

- Improving cash flow management

- Supporting maintain sustainable supply chains

- Supporting long-term planning of sustainability initiatives

- Improve accuracy and consistency of sustainability reporting

- Improve the engagement levels of finance team members by freeing time to focus on sustainability related strategic initiatives

Regardless of what motivates your company to automate the finance function, let us now explore how and where you can begin.

Take a Closer Look at Your Finance Function

Before looking at how to proceed with finance automation, take a close look at your finance department.

Finance function is made up of numerous workflows and processes involving data, systems and people. The role of automation is to coordinate these moving parts towards better overall efficiency. When this is achieved, the overall productivity will improve, delivering long term savings for your business.

Of course all of that depends on how you go about automation. A few miscalculations can result in delays and cost escalations.

Let us look at the many workflows and processes within and related to finance that may be ripe for automation. Exactly which ones can be automated and how depends entirely on you.When done right, Finance automation can enhance efficiency, accuracy, and compliance.

Before automation, however, your existing systems need to be reviewed and streamlined, to remove any obsolete, non-value-adding steps that were built into the systems over time, for reasons that have long since vanished. Most organisations have a few of these.

Some steps on how to analyse your processes with the aim of streamlining your processes to figuring out what to automate are outlined in a previous article: Streamline your corporate performance reporting: automate critical processes, eliminate the stupid.

Core Finance Processes Ripe for Automation

Here are some potential areas to automate in finance:

Some areas suitable for automation under each core process are listed below.

Budgeting, Forecasting, Financial Planning & Analysis:

Source to Pay (Purchasing & Accounts Payable):From vendor selection to accounts payable, many activities in the purchase cycle may benefit from automation.

Order to Cash (Invoicing & Accounts Receivable:This can cover the complete cycle of a sale beginning with issuing a quotation to receiving the payment from the customer. Depending on whether you consider all stages from quote to cash or order to cash, this involves:

Capital & Operating Expense Management

Payroll & Employee Expenses:

Contract Management

Reconciliations

Financial Reporting & Consolidations

Other Key Finance Processes That Can Benefit from AutomationThe following processes can also benefit from automation: Tax Compliance & Insurance

Cash Flow & Treasury Management

|

Where and How to Begin Finance Automation

To realise the true potential benefits of finance automation, beyond the business rationale, CFOs must consider expectations, metrics, cost benefits as well as the human aspects of automation. Technology feasibility, scalability and data protection too must be considered. A thorough vendor assessment must be part of the technology evaluation process.

Let us take a closer look at the steps and the preparation that should go into automating the finance function. Although listed in serial order, many of these steps can take place simultaneously, especially to keep the transition into automation to a minimum.

Clarify business rationale and strategic perspectives

Why is automation necessary? What strategic advantages can be expected from it? One key reason for automation is reducing ongoing costs, but that is usually not the only goal, as discussed above.

Analyse the costs and benefits of automation

Costs and benefits of automation must also be factored into your decision. Take a strategic, long term view for best results. Automation is not just about cost cutting. It is also about making your business more robust, resilient and agile, among the many goals we discussed earlier.

Your finance team needs to be re-skilled and motivated to help successfully lead those future challenges.

Besides costs of the automation itself, additional infrastructure costs, software and training, also factor in ongoing costs for platforms and services. Also consider costs of any potential downtime during the transition process from manual to automated.

Involve your IT department early

Expertise of the IT team will be of immense use in assessing the status quo, business processes which are ripe for automation as well as for identifying the best in class offerings, comparisons and vendor selection. However, it must be clear that the finance automation needs to begin with finance and overall business needs, rather than become another IT project. The ownership of driving the finance automation should rest with the CFO.

Take a closer look at the workflows and processes

Map out all the workflows and processes within the finance division. These are typically complex and interconnected with other divisions and operations across the business. You want to also consider volumes of transactions and the standardisation of tasks. You cannot automate business systems as they are. They need to be streamlined first, eliminating obsolete tasks and non value adding workflows for optimal results. (We talk more about this later in this article.)

Review software and systems in use now

The review should cover what is in use and what needs improvement. IT professionals and business analysts in your company can be of help. Most finance divisions typically use a number of software, services and platforms to get their work done. Depending on the business size, these may include accounting software, Enterprise Resource Planning (ERP), e-commerce and CRM software, analytics services and databases. You may also be using other software and services, in sales and marketing, human resources, operations and for identity management. Most businesses also use Excel, Office 365 and Google Sheets as well.

Evaluate technology infrastructure

Current technology and systems must be assessed, with the IT team, for compatibility with proposed new automation tools. Some legacy systems may overlap with new systems and may need to be retired. Will technology upgrades be enough? Are new capital investments necessary? What are they and how much will they cost?

Human aspects of automation

This applies to both finance talent and other teams that may be impacted. A key goal in automation is to save time so that you can deploy your finance team members in more productive and useful ways. Will there be redundancies when automation bears results?

List down all the skills that may be required in finance (and other functions) after the automation process is completed. Make an assessment whether these skills are available within the company and whether they can be developed in house with existing team members, especially those who are willing to take on more challenges. What need is there for reskilling? In some instances it may be necessary to recruit more specialised talent.

Automation calls for change management

Changes—in systems, structures, software, hardware and skills—will need to be made in the finance function and in other parts of the business. Automation typically calls for a cultural shift for embracing new technology, need for continuous learning and a new outlook on work practices. Need for change typically leads to some resistance. Clarifying the business rationale for automation together with clear and honest communication of cost benefits will help minimise resistance to change.

Decide on key performance indicators (KPIs) for finance automation

The key KPIs for finance automation projects include cost reduction, efficiency improvements, quality enhancement, reduction errors and downtime, return on investment (ROI), extent of scalability, data security improvements, and stakeholder satisfaction. You also must consider enhanced reporting capabilities and dashboards, and ease of collaboration.

Consider how differently the automated finance function would perform, compared to the status quo. These would be the yardsticks against which the success or failure of your automation process will be decided.

Set clear timelines when planning the finance automation

You want to minimise work disruptions. Many automation and other digital transformation projects experience cost and time overruns. The most common causes are poor initial planning and scope creep. Inadequate planning that lacks sufficient detail and failure to consider potential contingencies can delay projects and also lead to excessive costs. Scope creep happens when deliverables keep expanding or when stakeholders keep pushing back deadlines.

Also, change leaders need to recognise and appreciate that automation teams from finance and elsewhere will be working on automation related activities, in addition to their normal duties.

Choice of platforms and service providers

When using third-party tools, it is necessary to evaluate vendors for reliability, support, and track record in similar businesses and in the finance function. Besides all other requisite criteria, select services and platforms with lower set up times, to minimise disruptions to business, but without compromising quality and security.

Although date quality, integrity, security, privacy and compliance needs are part of the criteria when selecting automation tools, software or platforms, we mention them as separate points for greater emphasis.

Choose solutions that can be seamlessly integrated

True potential of finance automation can only be achieved with seamless integration among various systems, services and platforms of a business. Failure to seamlessly integrate your systems together, or the need for manual interventions to do so will reduce potential benefits of automation, including quality, speed and accuracy of output. Look for automation solutions that can fit in seamlessly into most, if not all, key software and platforms you are currently using.

It is important to remember that future oriented exercises like finance automation should not be overly burdened by old legacy systems, which may go out of commission within a couple of years.

Ensure data quality and integrity

When assessing vendors and technologies, consider how each service, software or platform ensures accuracy and reliability? Poor data quality undermines your investment in finance automation.

Ensure data security and privacy

How does the new vendor, system or platform ensure security of your data and protect sensitive information? Does the platform or software comply with industry standards? All benefits of automation will fall by the wayside if you run into security breaches following automation.

Factor in compliance and regulatory needs

Your new automated system must be compliant with industry regulations and legal standards. Neglecting this aspect can mean penalties later, adding on unnecessary costs and complications. Companies with overseas branches, operations and franchises must also ensure that their proposed systems also support compliance and regulatory needs in those locations.

Consider scalability of the new automation solution

Can it grow with your business and adapt to evolving needs? Will it need to be replaced within a short period because business growth has outpaced its usefulness?

You need to take a holistic approach to finance automation by carefully considering the above factors. Doing so will help ensure a successful transition from a manual or fragmented to a smoothly running automated finance function.

When Some Processes are Already Automated

How should you approach things if some processes are already automated? What you must do varies from business to business.

There are basically three choices you can make in this regard:

- Try to integrate the software or platform you are using already with the new automated solution. This may not always be possible, but there is no harm exploring the possibility. When integration is not possible you have two choices to go with.

- Go with the new, and ditch the old. This is easier said than done, especially with legacy software and preferences and territorial issues.

- Forget the new, and stay with the old. Again, not an optimal solution, because that goes against the whole concept of getting to a single source of truth, in terms of data within the entire business. You may end up with conflicting data from two sources. This is not a desirable place to be, for decision makers.

As you can see, this is why integration is critical.

Let us take a practical example. Many of MODLR’s clients use the following software, services and platforms. At present all of them can be smoothly integrated with the MODLR platform.

Click each link to better understand how the integrations work and what MODLR integrations enables you to do a lot more than is possible without such integration.

Accounting: MYOB | Sage | QuickBooks | Xero

Analytics: Google AdSense | Google Analytics | Spotify

CRM: Zendesk | Salesforce

E-Commerce: PayPal

Marketing: Mailchimp

Collaboration and notifications : Slack

Operations: Procore | Atlassian Jira

Databases: MySQL | PostgreSQL | Microsoft SQL | Oracle DBMS | SAP Hana | DB2Google BigQuery | Amazon Redshift | Hadoop | Azure | Snowflake | MongoDB | SingleStore

Human Resources: Sage MicrOpay | Readytech HR3Deel | Humanforce | EmpLive

ERP: Netsuite | Microsoft Business Central | Pronto | TechOne

Spreadsheet: Microsoft ExcelGoogle Sheets

Identity Management Systems: Okta | Azure AD | Google Workspaces

You can find the details about each by visiting our MODLR Integrations page

When a MODLR client wants a specific integration, besides those mentioned about, we will make that part of the MODLR setup process. In fact, some of the above integrations came about from such client requests.

The bottomline here is, when you want integrations with existing software, make sure to talk with your vendor during vendor selection. Ask whether integration is possible, and whether they will help you integrate a particular software or platform with your proposed automation solution.

Ask about what extra costs may be involved, and how this may affect your project completion timeline. Ensuring integration is possible and can be done easily and quickly is a key consideration in selecting products and vendors for finance (or any other) automation.

Doing Finance Automation Right - Best Practices

These best practices have helped businesses get the maximum benefits from automation while minimising challenges and risks.

On getting started

Involve your IT team early in the process

Top level sponsorship is absolutely critical

Choosing the best fit solution for your business

Phased implementation

What skills are necessary among finance staff to automate processes?

Know what it takes to achieve a high quality automation process

Communication and change management

Conclusion

In this article, we have discussed why finance automation makes business sense, the stages of the automation process and best practices to make automation a success.

Get in Touch with Us

We look forward to your questions and comments.

You can learn more about MODLR solutions by use case or industry on our website. Feel free to contact us if you need more details about MODLR products.